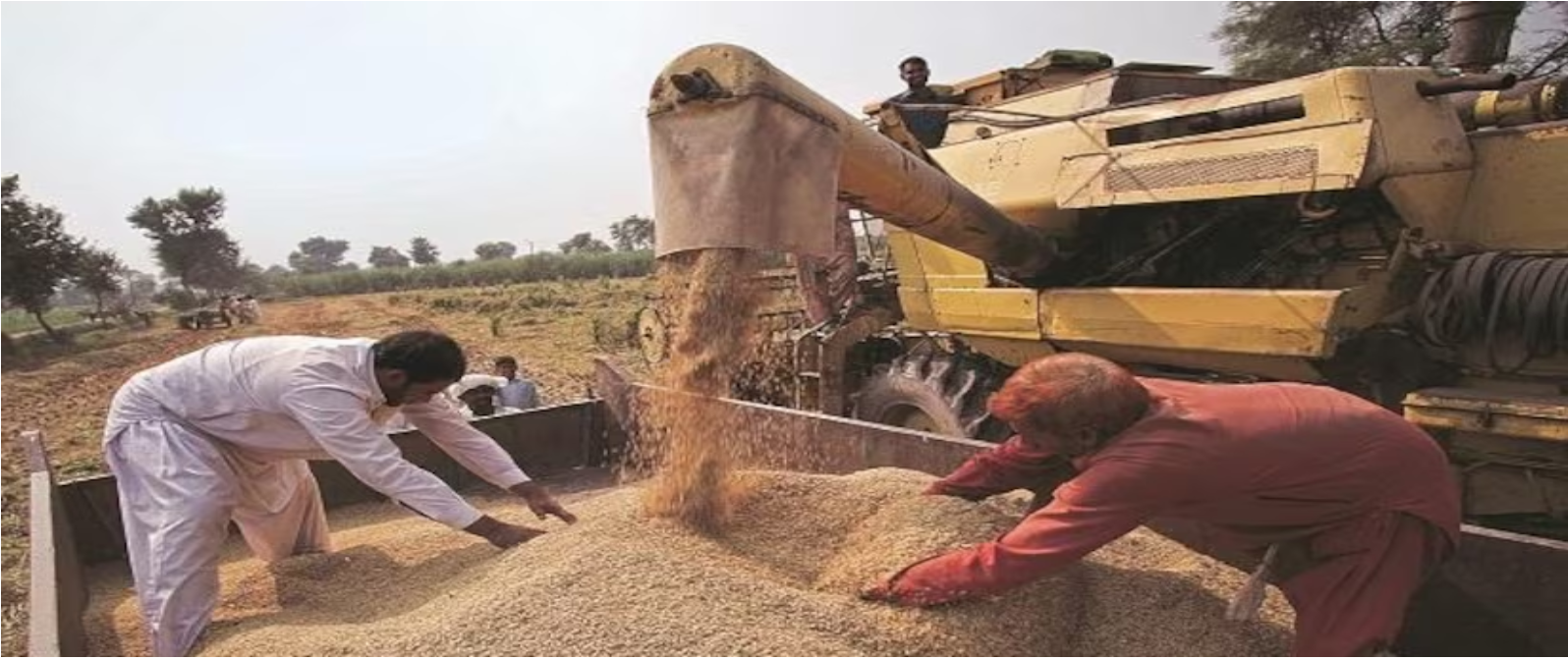

Wheat tops two-week high on global demand, traders eye Middle East

Chicago Board of Trade wheat futures pared gains on Monday after rising to their highest level in more than two weeks on hopes for global demand.

Corn futures eased as traders monitored the U.S. harvest, while gains in soyoil futures helped lift the soybean market, analysts said.

Traders in general monitored fighting between Israel and Hamas, with some stepping back from the markets due to uncertainty about the conflict.

“That’s keeping trader enthusiasm down,” said Jim Gerlach, president of A/C Trading in Indiana.

The most-active CBOT wheat contract was flat at $5.79-3/4 a bushel by 11:25 a.m. CDT (1625 GMT). The contract earlier reached its highest price in over two weeks at $5.88-1/2, extending a rebound after hitting a three-year low last month.

The strongest U.S. weekly export sales in more than a year and a second rare sale of soft red winter wheat to China boosted prices late last week.

“China has bought some U.S. wheat and there are expectations of more deals,” said one Singapore-based trader. “Lower quality U.S. wheat is competitive in the market.”

Still, competition for global export business from Black Sea origins remains strong, consultancy Agritel said in a note. Russia’s IKAR agriculture consultancy raised slightly its forecasts for the country’s overall grain production and exports this season.

CBOT corn eased 3-1/4 cents to $4.90 a bushel, while soybeans rose 5-3/4 cents to $12.86 a bushel. CBOT December soyoil climbed 1.7 cent to 56.08 cents per pound.

The U.S. Department of Agriculture said soybean export inspections were 2 million metric tons in the week ended Oct. 12, above analysts’ estimates. The USDA is slated to issue a weekly update on the nation’s corn and soy harvests at 3 p.m. CDT (2000 GMT).

The National Oilseed Processors Association (NOPA) said the U.S. soybean crush jumped last month to the highest-ever level for September, while end-of-month soyoil stocks thinned to the lowest in nearly nine years.