Rex Reports Strong Q1, Announces Progress With Capacity Expansion And CCS Projects

Rex American Resources Corp. achieved near-record financials in Q1 2024, with $161.2M in net sales, up from $212.7M in Q1 2023. Ethanol sales rose 4%. The company secured 100% rights of way for a 6-mile carbon pipeline and reported plans to expand One Earth Energy ethanol plant capacity to 200 MMgy. Construction for carbon capture facilities is on track, expecting completion by Q4. Net income attributable to Rex shareholders increased to $10.2M.

Rex American Resources Corp. on May 22 reported that the company achieved near-record financial results during its fiscal first quarter of 2024. The company also announced it secured 100% of the rights of way for its planned 6-mile carbon pipeline.

Rex sold 74.5 million gallons of ethanol during the fiscal first quarter of 2024, which is the three months ended April 30. Ethanol sales were up approximately 4% when compared to the same period of 2023. During a first quarter earnings call, Rex Executive Chairman Stuart Rose said the company’s first quarter results were among the best in the company’s history, noting the three-month period was the second most profitable first quarter the company has experienced from a net income per share perspective. Rose attributed the strong performance to lower natural gas and corn prices along with the excellent performance by the company’s team despite weaker pricing for both ethanol and coproducts.

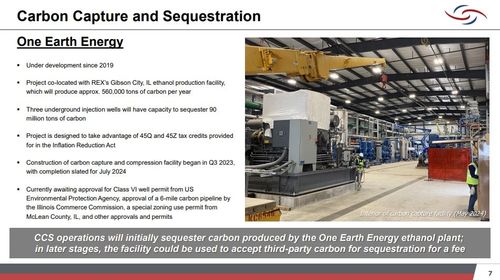

Rose discussed ongoing projects to increase the production capacity of the company’s One Earth Energy ethanol plant in Gibson City, Illinois, and add carbon capture and storage (CCS) capacity to the facility. He said the company is on track to expand capacity at One Earth Energy to 175 MMgy and plans to apply for a permit from the U.S. EPA to further increase production to 200 MMgy. Zafar Rizvi, CEO of Rex, said the initial expansion is expected to be complete in the fourth quarter. He also explained that no additional construction will be needed to boost capacity to 200 MMgy.

According to Rizvi, construction of the capture and compression facility for the One Earth Energy CCS project remains on track to be complete in July. The carbon capture and compression facility, however, is unlikely to be connected to the electric grid before the fourth quarter. Rizvi said efforts to secure a Class VI well permit from the EPA continue, with the company currently expecting to receive that permit by the first quarter of 2025.

The pipeline portion of the CCS project is also progressing. Rex reported it has reached agreement with 100% of the landowners for rights of way for the planned 6-mile carbon pipeline, which will connect the carbon capture facility at the One Earth Energy facility to the planned injection wells. Those agreements eliminate the need to use eminent domain to develop the pipeline.

Rex is the majority owner of Gibson City, Illinois-based One Earth Energy LLC and Marion, South Dakota-based NuGen Energy LLC. Those two facilities have a combined capacity of 300 MMgy. The company also holds ownership shares in West Burlington, Iowa-based Big River Resources West Burlington LLC; Galva, Illinois-based Rig River Resources Galva LLC; Dyersville, Iowa-based Big River United Energy LLC; and Boyceville, Wisconsin-based Big River Resources Boyceville LLC. Those four plants have a combined capacity of 425 MMgy.

For the fiscal first quarter of 20254, Rex reported net sales and revenue of $161.2 million, compared to $212.7 million during the same period of 22023. Gross profit was $14.5 million, up from $10.2 million. Net income attributable to Rex shareholders was $10.2 million, up from $5.2 million. Fiscal first quarter diluted net income per share attributable to Rex common shareholders was 58 cents, compared to 30 cents per share during the same period of last year.

Source Link : https://ethanolproducer.com/articles/rex-reports-strong-q1-announces-progress-with-capacity-expansion-and-ccs-projects