Feed prices remain high despite record maize harvest, low rates

Despite a potential record maize harvest leading to lower maize prices, small livestock and poultry farmers still face high feed costs. Maize prices have dropped to Tk 24-28 per kg, yet processed feed prices remain inflated. Poultry feed costs Tk 60-75 per kg, squeezing profits for farmers. The Bangladesh Poultry Association highlights the dominance of major companies, exacerbating the plight of small-scale farmers. Agribusiness experts urge regulation to benefit both farmers and consumers.

While a possible record maize harvest has led to a decline in maize prices this year during peak harvesting season, small livestock, fisheries and poultry farms are seeing minimal benefit as feed costs remain high.

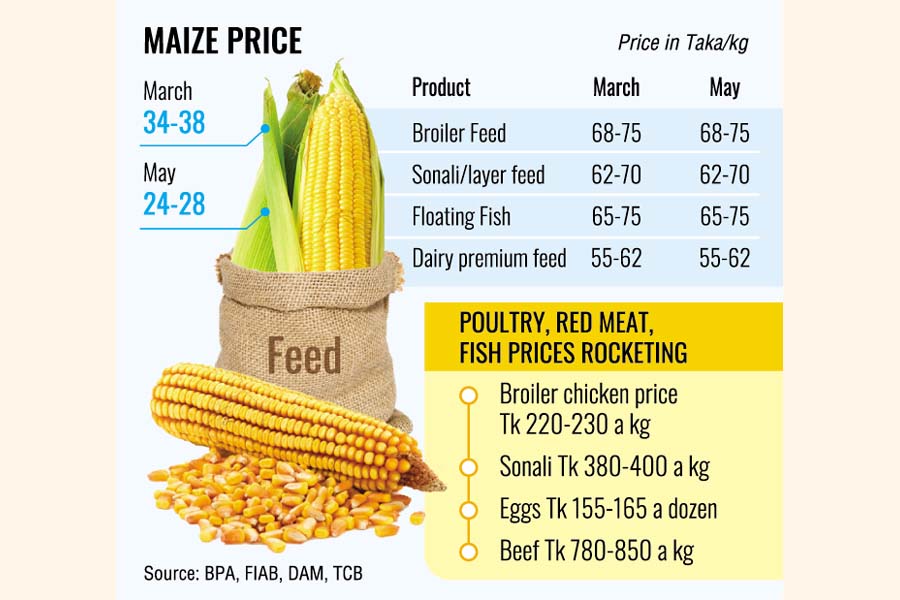

Farmers and seasonal traders in the northern and southwestern regions report that maize is now selling at Tk 24-28 per kg from farm level to mill gate — down from Tk 32-38 per kg two months ago.

However, the feed industry syndicate is accused of maintaining inflated prices for processed feed products despite the 40 per cent drop in maize prices.

Poultry feed, fish feed and dairy feed remain at Tk 60-75 and Tk 58-65 per kg, respectively, according to Kamrul Huda Shantu, a farmer-cum-trader at Parbatipur in Dinajpur.

Shantu said farmers are selling maize at Tk 22-24 per kg. The price has decreased by Tk 10-12 per kg since the harvest began in the northern regions.

Agents from large feed companies are offering lower prices for maize, he added.

With the urgent need for money to begin Aman cultivation, farmers are forced to sell maize at a limited profit margin of 10-12 per cent.

Mahmudul Hoque Shamim, a trader at Dimla in Nilphamari, said agents from Quality Feed, Paragon, ACI, Kazi and other companies are buying maize at Tk 26-28 per kg.

Helal Uddin, a poultry farm owner in Dohar, Dhaka, told The Financial Express that feed prices remain at Tk 75 per kg, while a single bird requires at least two kilograms of feed to reach maturity.

This, combined with the high cost of day-old chicks, has pushed production costs above Tk 195 per kg. Consequently, farm owners are barely making a profit of Tk 4.0-6.0 per kg, according to Mr Uddin.

He said many farmers have been forced to close their businesses in the past two years due to the high input costs.

Suman Hawlader, president of the Bangladesh Poultry Association, said six to seven major poultry companies dominate the feed, day-old chicks and egg markets.

These companies possess both giant hatching industries and feed mills, he said.

According to Mr Hawlader, the big corporates offer day-old chicks and feed at much lower rates, but only to their contract farmers.

He said, “The rest of the 50,000 small and medium-scale farmers struggle to survive as they are forced to buy these products at much higher prices.”

Mr Hawlader also alleged that the feed mill syndicate has taken over the maize market during this harvest season. These companies, along with their allied traders, are manipulating prices because most farmers do not have storage capacity to hold onto their crops for extended periods.

Contacted for comment, Md Jahid Hossain, supply chain head of Nahar Poultry Ltd, admitted the price difference.

He said that while villages trade moist maize at Tk 24-28 per kg, companies require dry maize, which they purchase at Tk 32 per kg. Prices were previously higher, at Tk 36-38 per kg before the harvest began.

Mr Hossain said another feed ingredient soya cake is still costlier, as it remains at Tk 65-68 per kg. Companies might reduce feed prices within a few weeks if the maize market stabilises.

Agribusiness expert Prof Dr Rashidul Hasan said maize constitutes 60 per cent of the animal feed composition.

He credited the farmers’ enthusiasm for maize cultivation with Bangladesh achieving near self-sufficiency in production in recent years. Maize cultivation, according to Prof Hasan, now offers some of the highest returns compared to other crops.

He said local feed mills are collecting maize at a much lower rate compared to the global market, where import costs have skyrocketed due to the rising US dollar.

According to the agribusiness expert, good returns for farmers should be ensured to encourage continued maize production in the coming year.

Looking towards the consumer end, he hoped that the record maize harvest will translate into lower prices for poultry products, fish, cattle meat and milk.

“But chicken, beef, eggs and fish prices have all reached new highs this year,” he acknowledged the ground reality.

Prof Hasan urged the Ministry of Fisheries and Livestock to regulate the feed market so that both farmers and consumers are benefited.

According to the Trading Corporation of Bangladesh (TCB), Department of Agricultural Marketing (DAM) and city kitchen markets, eggs prices shot up to new highs this year at Tk 155-165 a dozen, broiler chicken hits Tk 220-230 a kg, beef Tk 780-850 a kg and cultured ruhi Tk 350-500 a kg.

According to the Feed Industries Association of Bangladesh (FIAB), the country’s annual demand for animal feed is nearly 6.5 million tonnes. Local feed millers now produce nearly 99 per cent of this total demand.

The agriculture ministry forecasts a yield of 5.8 million tonnes of maize this year, following a record-breaking harvest of 4.6 million tonnes last year.

Source Link: https://thefinancialexpress.com.bd/trade/freight-container-spot-rates-mounting