UK maize imports start 2024/25 at record pace: Grain market daily

UK maize imports for the start of the 2024/25 marketing year reached a record 515 Kt in July and August, up 28% from last year and 37% above the five-year average. Factors driving these imports include expectations of reduced domestic wheat production and falling global maize prices, influenced by favorable conditions in the U.S. leading to the second-largest maize crop on record. Lower prices have also made maize competitive for animal feed and industrial use, further supporting demand.

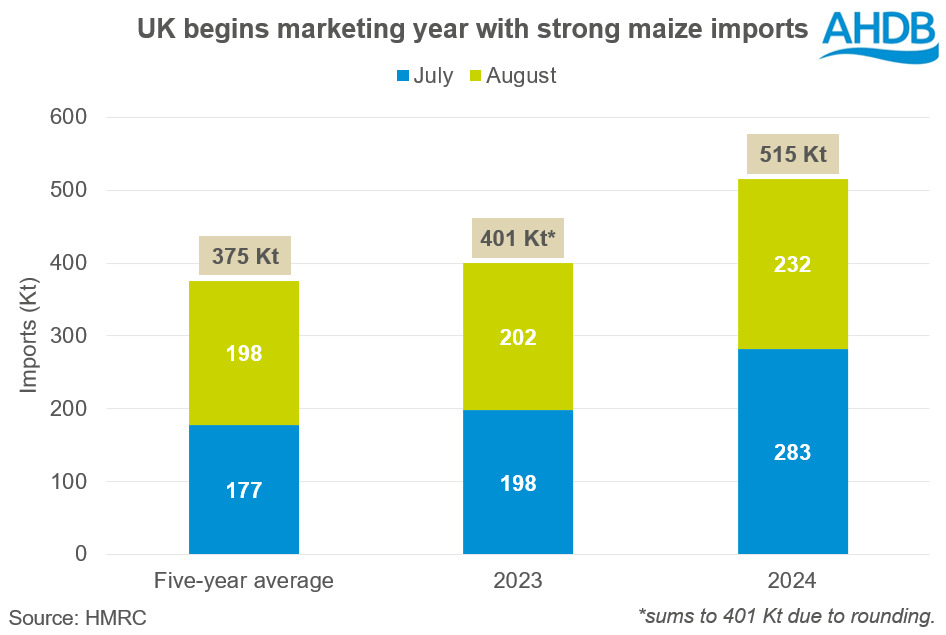

The latest UK trade data shows maize imports at 515 Kt for July and August, 28% greater than last year and 37% more than the five-year average. The sum of July and August imports are also the largest since at least 2000 (electronic records).

Wheat imports have also begun the marketing year strongly. The rise of grain imports has been encouraged due to the expected sharp fall in domestic wheat production (shown in English data out last week and UK data on Tuesday).

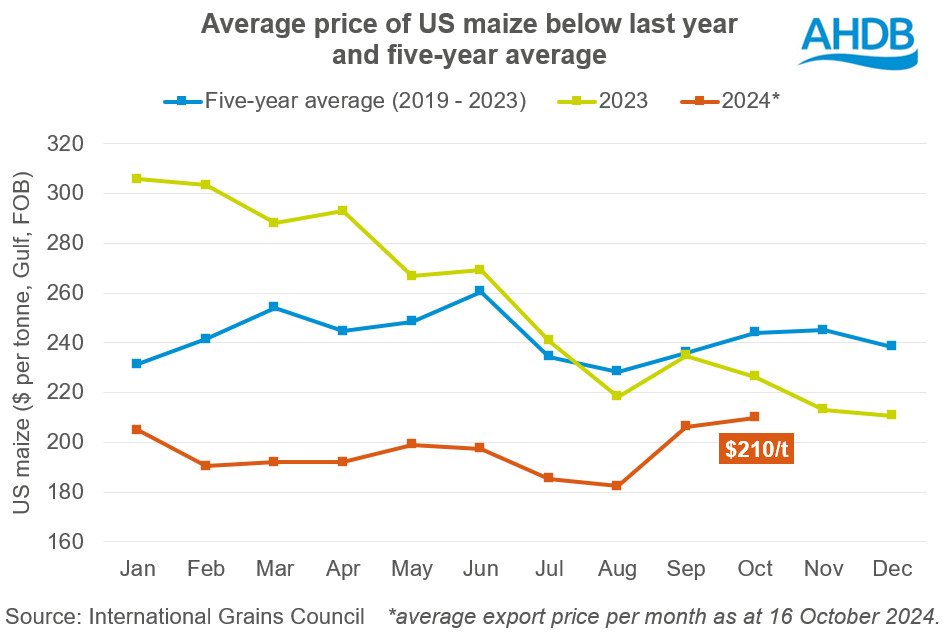

A slide in global maize prices is also an important factor. Maize prices came under pressure as the second largest US maize crop on record developed in favourable conditions during the summer and is being harvested at an above average pace.

Prices from the US, usually the largest global exporter of maize, clearly show the global trend. While US maize for export (FOB) had begun the year at $205/t (January average), prices dropped below $200/t during the spring and summer months. This was as anticipation of plentiful global supply developed in response to expectations of the second largest US maize harvest.

The crop continued to be reported in above average conditions during its development and the average price fell as low as $182/t for August, when the US Pro Farmer Crop Tour also reassured the market of an ample US maize crop. However, recently, maize prices have lifted after Eastern European and Ukrainian maize yields suffered from a heatwave. Plus, they tracked gains in the wheat market in response to dryness in key wheat-producing regions.

Looking ahead

For the UK, lower domestic cereals production is likely to continue to encourage above average grain imports. Whole and flaked maize for GB compound animal feed usage recorded a yearly rise of 23% for July and August. This was the greatest rise across all other feed types suggesting that maize has already become more competitive in the feed ration and rations can often remain consistent through livestock life stages for monogastric.

Also, industrial grain users, including the Ensus biofuel plant, and some grain distillers have the option to use maize, as well as wheat.

As maize prices remain competitive against rival cereals on the global stage, this could also support import demand for maize. But the price relationship between wheat and maize will need to be monitored.

Source Link : https://ahdb.org.uk/news/uk-maize-imports-start-2024-25-at-record-pace-grain-market-daily