Fuel Ethanol Market Size, Share and Trends 2024 to 2034

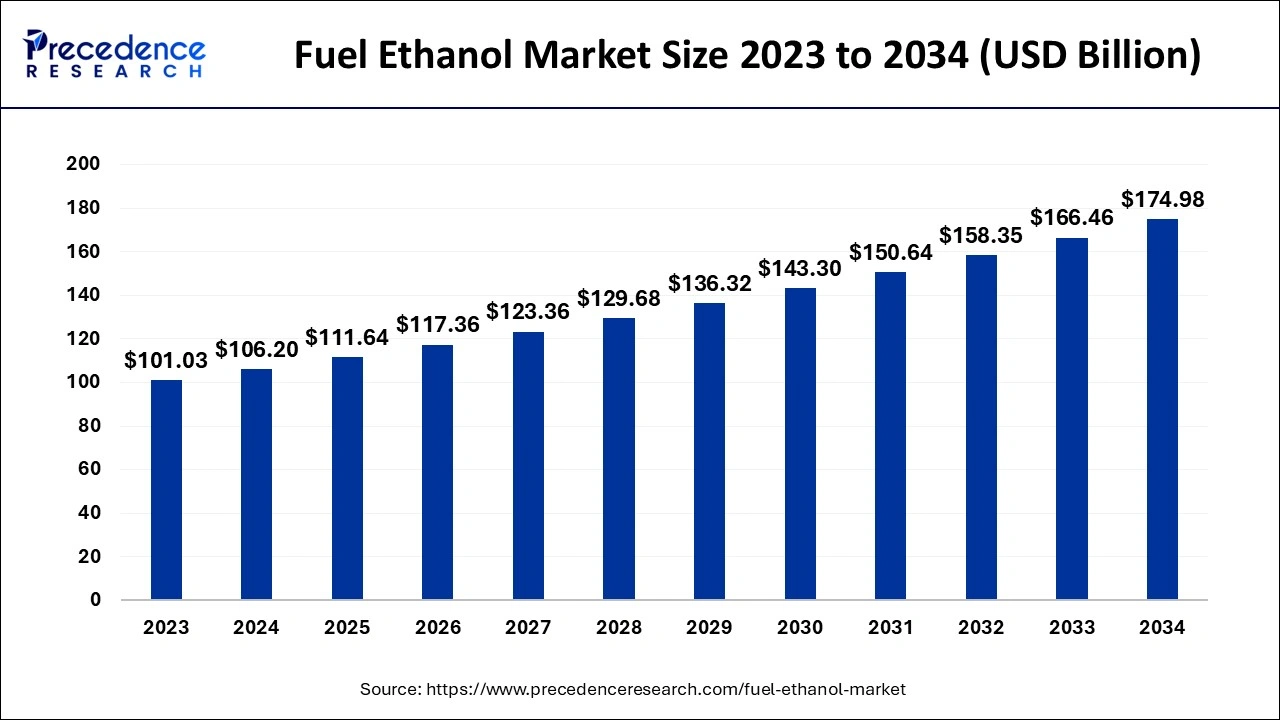

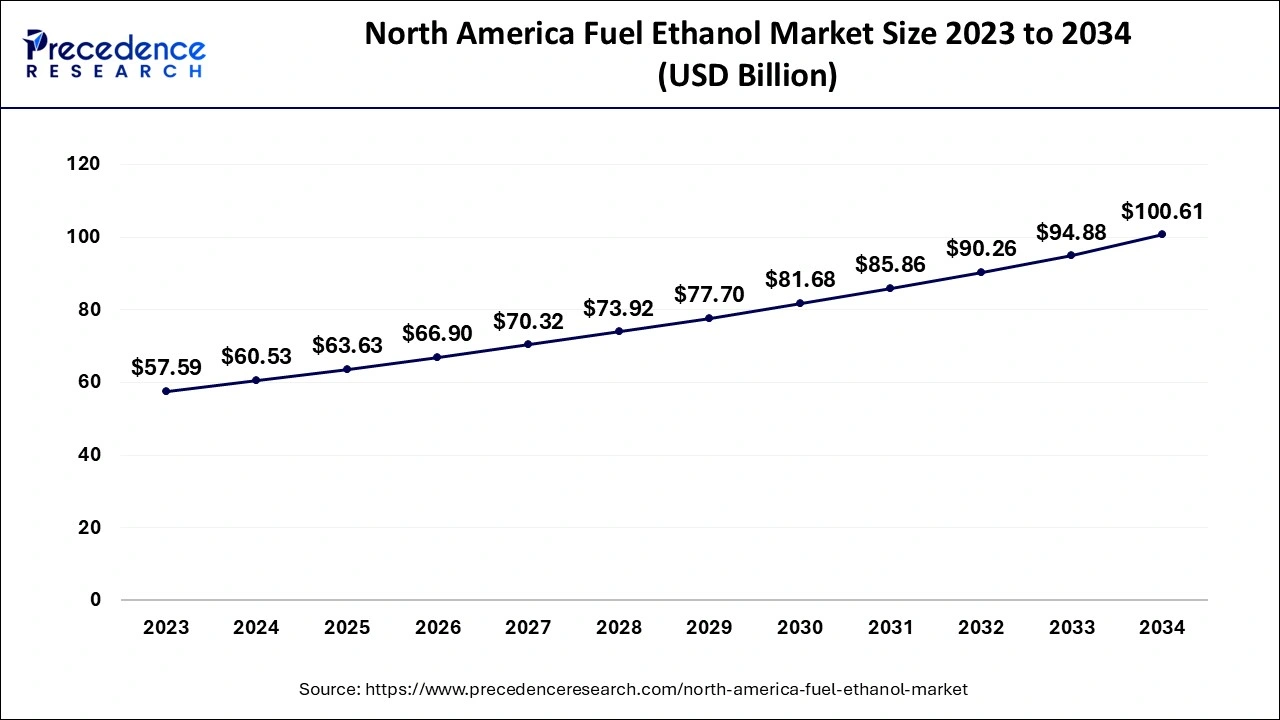

The global fuel ethanol market size accounted for USD 106.20 billion in 2024, grew to USD 111.64 billion in 2025 and is expected to exceed around USD 174.98 billion by 2034, registering a CAGR of 5.12% between 2024 and 2034. The North America fuel ethanol market size is calculated at USD 60.53 billion in 2024 and is expected to grow at a CAGR of 5.20% during the forecast year.

The global fuel ethanol market size accounted for USD 106.20 billion in 2024, grew to USD 111.64 billion in 2025 and is expected to exceed around USD 174.98 billion by 2034, registering a CAGR of 5.12% between 2024 and 2034. The North America fuel ethanol market size is calculated at USD 60.53 billion in 2024 and is expected to grow at a CAGR of 5.20% during the forecast year.

Fuel Ethanol Market Size and Forecast 2024 to 2034

The global fuel ethanol market size is calculated at USD 106.20 billion in 2024 and is predicted to reach around USD 174.98 billion by 2034, expanding at a CAGR of 5.12% from 2024 to 2034. The fuel ethanol market growth is attributed to increasing demand for sustainable energy solutions, government-driven renewable energy initiatives, and technological advancements in ethanol production.

Fuel Ethanol Market Key Takeaways

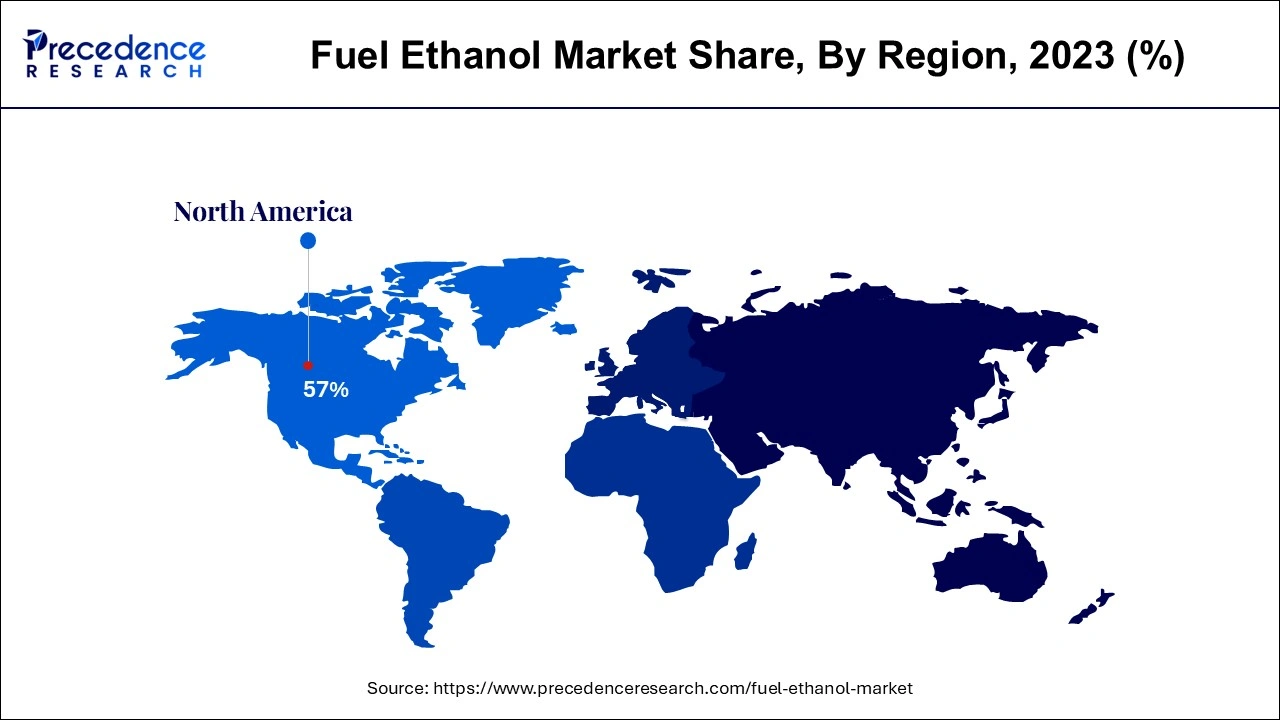

- North America dominated the global fuel ethanol market with the largest market share of 57% in 2023.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By product, the starch-based segment contributed more than 76% of the market share in 2023.

- By product, the cellulose segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034.

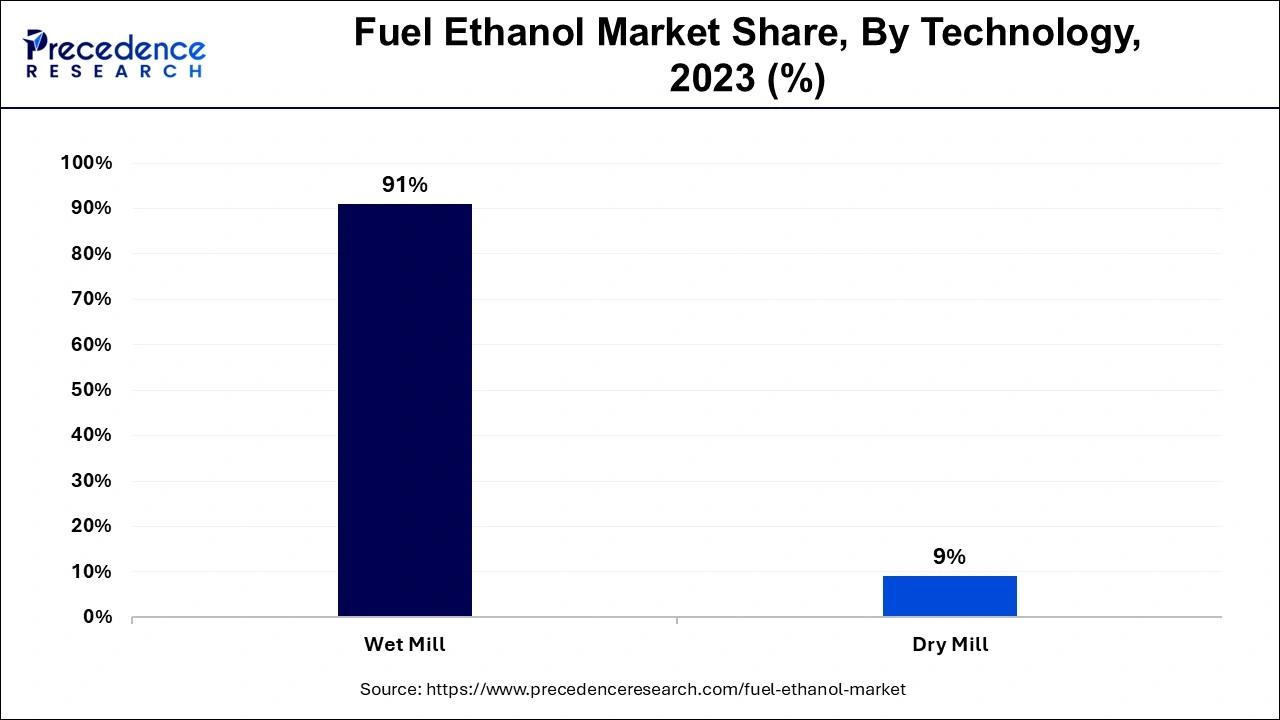

- By technology, the wet mill segment accounted for the major market share of 91% market in 2023.

- By technology, the dry mill segment is anticipated to grow with the highest CAGR in the market during the studied years.

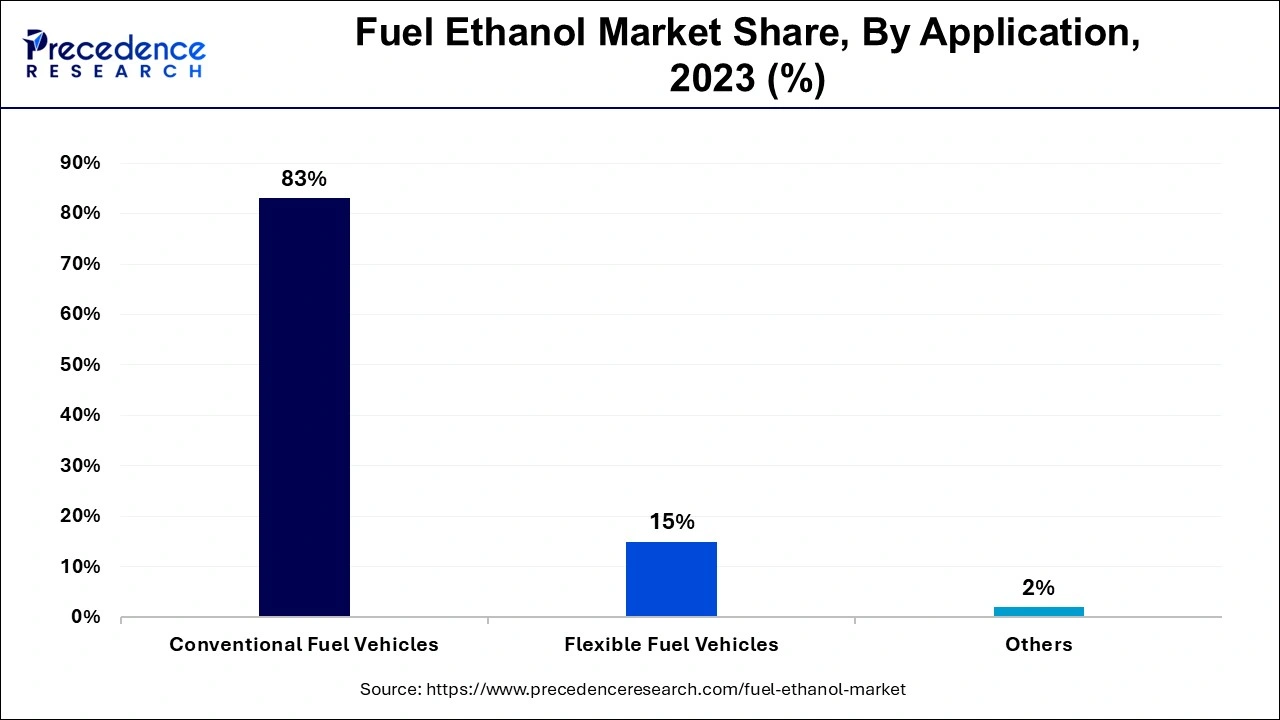

- By application, the conventional fuel vehicles segment recorded more than 83% of the market share in 2023.

- By application, the flexible fuel vehicles segment is projected to expand rapidly in the market in the coming years.

North America Fuel Ethanol Market Size and Growth 2024 to 2034

The North America fuel ethanol market size is exhibited at USD 60.53 billion in 2024 and is projected to be worth around USD 100.61 billion by 2034, growing at a CAGR of 5.20% from 2024 to 2034.

North America dominated the global fuel ethanol market in 2023, owing to government support, developed infrastructure, and a large agricultural sector. Production policies, such as the renewable fuel standards, require the inclusion of renewable fuel in gasoline, which supports ethanol production and distribution. The largest use of ethanol is blending with gasoline to act as an oxygenate to reduce emissions.

Asia Pacific is projected to host the fastest-growing fuel ethanol market in the coming years, owing to the rising urbanization and industrial development in countries such as China, India, and Thailand. National and local administrations promptly pursue biofuel strategies to control emissions and decrease external oil dependence, justified by an international commitment to ecological protection.

- India’s National Biofuel Policy has set a target to ensure 20% ethanol blended with gasoline by 2025, which is up from current levels. This growth is expected to strengthen the demand for ethanol as governments put in place enabling policies to enable renewable energy goals to be met.

Market Overview

There is increased concern for renewable sources of energy fuelling the growth of the fuel ethanol market. The governments of nations around the world are incorporating stiffer standards for renewable energy and comprehensive targets for cutting back on carbon output. There is the U.S. Renewable Fuel Standard (RFS) program, where biofuels, including ethanol, have to be mixed with gasoline, and volume is set in the coming years.

- The EU RED II demands that the share of biofuels, including ethanol, be at least 14% of energy utilized in the transport sector by 2030.

This is likely to force efficiency improvements in production technologies, particularly in cellulosic ethanol production, which is produced from animal waste and crop residues. Furthermore, the emergence of wet and dry milling is improving productivity and costs, hence positioning ethanol in the appropriate place in the market as a renewable source of energy.

Impact of Artificial Intelligence on Fuel Ethanol Market

Artificial Intelligence (AI) systems in ethanol production have enhanced decision-making in a variety of aspects, including timing of numerous production processes, cost reduction, and improvement of efficiency in the fuel ethanol market. Current technology helps various algorithms that, in turn, may help producers adapt their production calendar. The use of automation through the adoption of AI in ethanol plants has cut down on many errors that would have been made by human personnel and, at the same time, increased production rates. Additionally, this technology is instrumental in enhancing the supply chain logistics by acting as a forecaster of the demand for various products.

Fuel Ethanol Market Growth Factors

- Rising government mandates for renewable energy: Countries are increasingly enforcing renewable energy standards, driving demand for ethanol in transportation fuels.

- Technological advancements in biofuel production: Innovation in second and third-generation biofuels, such as cellulosic ethanol, is expanding ethanol’s market potential.

- Growing consumer preference for eco-friendly fuels: A shift toward cleaner, renewable energy sources is encouraging greater ethanol consumption in the automotive sector.

- Expansion of ethanol blending requirements: Increasing ethanol blend limits in gasoline, such as the adoption of E15 and E85, is fuelling market growth.

- Investment in infrastructure for ethanol production and distribution: Enhanced infrastructure in both developed and emerging markets is enabling easier access to ethanol fuel.

- Government subsidies and incentives for ethanol producers: Financial support for the biofuel sector, especially in countries like the U.S. and Brazil, is stimulating production capacity.

- Increased adoption of ethanol in the chemical and industrial sectors: Ethanol is increasingly being used as a feedstock for producing bio-based chemicals, expanding its market beyond transportation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 174.98 Billion |

| Market Size in 2024 | USD 106.20 Billion |

| Market Size in 2025 | USD 111.64 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Increasing demand for clean energy

Increasing demand for clean energy is expected to drive the growth of the fuel ethanol market. The fundamental factor affecting the development of ethanol production is the growing need for environmentally friendly energy sources as governments and industries of the world turn to unleashing pollutants in the atmosphere. This shift emphasizes biofuels, such as ethanol, which is considered a safer fuel than fossil fuels.

- The United States Environmental Protection Agency (EPA) has lately established new Renewable Fuel Standards RFS for 2023-25 that set biofuel volumes that will actionize a fresh U.S. energy security coverage able to decrease dependence on foreign crude by 130,000 to 140,000 barrels per day approximately.

Many nations have long-term targets for the use of renewable energy sources, which creates more demand for ethanol as a key player in the fuel ethanol market shift toward these targets. Furthermore, according to IEA, ethanol is on the rise, and many countries, including Brazil and India, are in the process of boosting the production of ethanol as an essential part of long-term renewable energy strategies.

Ethanol Production and Global Renewable Energy Share (2023-2024)

| Year | Renewable Energy Volume (in billion gallons or percentage) | Focus on Renewable Energy |

| 2023 | 20.94 billion gallons of ethanol are projected to be used as a renewable fuel standard in the U.S | Increased volume in renewable fuel targets. |

| 2024 | 21.54 billion gallons of ethanol are projected to be used as a renewable fuel standard in the U.S. | Growth in biofuel adoption across the U.S. |

| 2023 | Over 15% of global energy is from renewable sources, primarily ethanol in transportation. | Global shift towards renewable energy sources. |

| 2024 | Aiming for 20% renewable energy share globally by 2024. | Increased government incentives for clean energy. |

| 2023-2025 | Steady growth in U.S. ethanol from 20.94 billion gallons to 22.33 billion gallons. | Regulatory targets driving renewable energy integration. |

| 2024 | India aims to blend 10% of its ethanol in fuel. | Focus on biofuel development as part of renewable targets. |

| 2023-2024 | Brazil’s ethanol production growth is forecasted at 5% per year. | Continued investments in ethanol as part of the renewable energy transition. |

Restraint

Limited infrastructure for ethanol distribution

The lack of ethanol distribution and retailing infrastructure is hindering the fuel ethanol market. Ethanol needs specialized fuel pumps, storage tanks, and transport in a way that is sometimes unavailable in parts where traditional fossil fuel rules the market. Although RFA has reported major achievements in ethanol infrastructure in the United States, there is still limited achievement in rural and developing regions where there is a slow rate in the use of ethanol-blended fuel. The limitation in distribution structure is believed to inhibit the expansion of alcohol usage progressively worldwide, especially in regions where infrastructure is yet to be enhanced. This causes a slowing down of the change to cleaner biofuels, mostly in those countries that are in development.

Opportunity

High governmental support for ethanol blending

Supportive governmental policies and subsidies are expected to create immense opportunities for the players competing in the fuel ethanol market in the coming years. Governments around the world are providing strong policy support for ethanol blending into gasoline. Second-generation biofuels, notably cellulosic ethanol, are also being invested in assets as part of the shift from food crops-based feedstock. These fuels are derived from crop residues from agriculture or forestry and are far better options than first-generation bioethanol.

In the United States, bioenergy is being developed with the objective of replacing first-generation biofuels through investment in the Department of Energy, which supports several cellulosic ethanol projects. Additionally, through the Higher Blends Infrastructure Incentive Program (HBIIP), which is part of the Biden-Harris administration, the authorities are supporting the introduction of facilities for biofuel ethanol blending.

- The U.S. Department of Agriculture (USDA) has also been progressively financing efforts to ensure the development of the infrastructure of biofuels, including cellulosic ethanol. The USDA has committed over USD 180 million to more than 200 projects supporting biofuel production in the region.

Product Insights

The starch-based segment held a dominant presence in the fuel ethanol market in 2023, as it has inherited production facilities and feedstock ability. The U.S. DOE (Department of Energy) supports the growth of corn-based ethanol through a number of subsidies and tax credits. Moreover, the EPA has other policies regarding renewable fuels, such as making ethanol to help achieve greenhouse gas reduction goals. The increased global focus on the need for biofuels, especially in the transport sector, further boosts the need for corn-based ethanol.

- In 2023, approximately 94% of the U.S. ethanol production was from corn due to programs, such as the Renewable Fuel Standard (RFS), that promote the use of these renewables.

The cellulose segment is expected to grow at the fastest rate in the fuel ethanol market during the forecast period of 2024 to 2034, owing to the enhancement in government support policies, increasing technology application, and raising awareness of environmental issues. Additionally, there is a growing focus on the commercialization of renewable fuels in the automotive sector.

- In 2023, the U.S. DOE continued to support several projects that aim to develop cellulosic ethanol production technologies with few biological and chemical conversion processes. The DOE’s Bioenergy Technologies Office (BETO) is directing USD 11 million towards five new cellulosic ethanol initiatives.

Technology Insights

The wet mill segment accounted for a considerable share of the fuel ethanol market in 2023 due to its higher efficiency in starch extraction. This method results in higher production of ethanol per bushel of the feedstock than dry milling. This feature is relatively advantageous in regions such as the United States, where corn is the feedstock. Wet mill technology has been preferred for large centralized ethanol production plants for the production of other valuable byproducts, such as corn gluten feed and corn oil, appealing to the animal feeds and biodiesel segments, respectively.

As claimed by the U.S. Department of Energy, more than one-third of total ethanol production in 2023 is contributed by wet mill plants in the U.S., primarily due to government policies, such as the Renewable Fuel Standard (RFS).

The dry mill segment is anticipated to grow with the highest CAGR in the fuel ethanol market during the studied years, owing to the fact that lesser capital expenditure is needed in dry milling than in wet milling. Cry mills were established, mainly in the United States of America and Brazil, since they are cheaper to set up for small to medium-scale farmers. Furthermore, growing global consumption of bioenergy, such as ethanol, used in cars instead of gas due to the effects of climate change further fuels the segment.

- The U.S. Energy Information Administration observes that trends in dry milling show that by 2023, the general ethanol production in the United States will approach 70% of the total amount produced using this technique. This growth can especially be attributed to the lower energy requirements of dry milling and a generally lower cost of production.

Application Insights

The conventional fuel vehicles segment led the global fuel ethanol market, as standard ethanol blended with gasoline is E10 (having 10% ethanol and 90% gasoline) and E15, which do not cause compatibility issues with most conventional fuel vehicles. The mechanisms include mandates by governments, such as the renewable fuel standard that has greatly boosted ethanol utilization in regular cars since automakers meet the specified blending rates. The previously established infrastructure for fuelling stations that provide ethanol-blended gasoline, on the other hand, also contributes to market domination by conventional fuel vehicles.

The flexible fuel vehicles segment is projected to expand rapidly in the fuel ethanol market in the coming years, owing to the growing customer preference for cars that produce fewer emissions and OEMs’ higher emission standards set by different governments. The positive outcome is shown in the countries that use this technology, such as Brazil, and similar trends have increased in countries, including the United States and India, where FFVs are beginning to become popular. Furthermore, the continuous advancement of higher ethanol blends strengthens the growth of the FFV segment, as this vehicle uses ethanol concentrations without affecting engine efficiency.

To read more about Ethanol Industry News, continue reading Agriinsite.com

Source Link : Precedence Research