Sugar production and sugar demand stay high in the U.S.

The U.S. sugar industry has seen record production in 2023-24, with a combined crop of sugarbeets and sugarcane reaching 9.4 million short tons. Despite strong production, demand remains stable, supported by the growing U.S. population. The U.S. produces about 75% of its demand, with global factors like subsidies in India, Brazil, and Thailand affecting market prices.

It’s been a big year for sugar production, but demand has been keeping pace.

Rob Johansson, director of economics and policy analysis for the American Sugar Alliance, speaking at the National Association of Farm Broadcasting annual convention in Kansas City, Missouri, in November, said the U.S. Department of Agriculture pegged the marketing year 2023-24 combined crop of sugarbeets and sugarcane at nearly 9.4 million short tons — a record. The November Sugar and Sweeteners Outlook from USDA put beet sugar at 5.236 million short tons.

“So that was a record, and we were looking at another great crop coming in next year as well this coming year, just being harvested right now and piled up,” he said.

The Sugar and Sweeteners Outlook estimated the 2024-25 sugarbeet harvest at 32.7 tons per acre, which included yield reductions in Michigan, Minnesota, and Montana offsetting higher production in other states. The resulting estimate for total sugar was 5.245 million short tons.

The report put 2023-24 cane sugar at 4.133 million short tons, the second highest level on record, behind only 2020-21.

The American Sugar Alliance is the national coalition of sugarbeet and sugarcane growers, processors and refiners. In his role there, Johansson analyzes and models domestic and world sugar supply and demand fundamentals and domestic and foreign sugar and general agricultural policies, including farm bill topics and international trade negotiations. Johansson previously served as the USDA chief economist from January 2015 to January 2021

Along with good agronomic conditions and factory production on the sugarbeet side, conditions also have been favorable for sugarcane in the U.S.

“On the cane side, we also had good, you know, just normal production in Florida. Louisiana bounced back from their drought two years ago to have a very good crop this year, so Louisiana production was up,” Johansson said.

But even with all that sugar, there’s been plenty of market for it, he said.

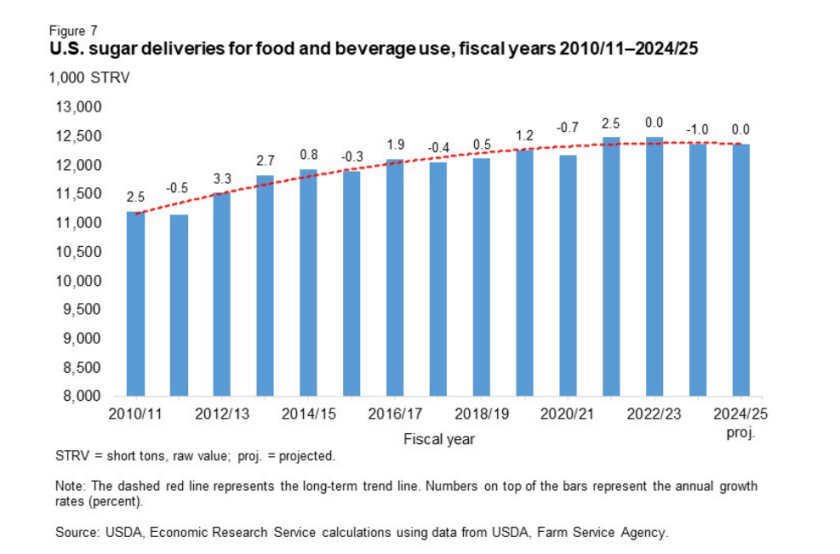

“After the pandemic, we saw some stockpiling that went on by food companies in terms of their inventory. So we did see demand really shoot up right after the pandemic. It’s flattened, and, I would say, leveled off,” he said. “After that, we haven’t seen it fall.”

The growing population of the U.S. helps keep demand “pretty constant” and rising slightly, he explained

“Overall U.S. demand is about 12.4 million tons, so we’re producing about 75% of that domestically,” he said.

Johansson said good prices for producers are always the hope for the sugar industry, but a lot of that depends on what happens with global sugar supply.

“So we’re seeing both India, Brazil and Thailand continually subsidizing their industry. So we’re worried a little bit about too much sugar being dumped on the world market. That drops world prices, and that’ll bring the U.S. price down with it as well,” he explained.

However, Johansson said world prices seem to be staying in a “reasonable range” that keeps U.S. prices at a point that allows sugar producers to cover their costs.

“As you know, costs of production have been up over the last couple years, and being able to invest in operations, new machinery, new seed technology, is something that our producers need to have a decent price in order to be able to do that. So we’re hoping for a fair price right now,” he said.

As with the rest of the ag world, Johansson said the sugar industry is waiting on a new farm bill.

“We know that this past year, you know, politics sort of took a lot of air out of the environment,” he said. “Everybody was focused on the elections. Now that those are over, we’re asking Congress to try and get a new farm bill done as soon as possible that helps all producers, not just sugarbeet and sugarcane producers.”

Johansson said for bankers to keep lending needed operating capital to farmers, Congress needs to pass a farm bill that provides an adequate safety net.

“So that’s mainly what we’re pushing for right now,” he said. “We need to have a new farm bill.”

To read more about Sugar Industry continue reading Agriinsite.com

Source : AG Week