India’s net sugar production in 2024-2025 season expected to decline by 4.6 MMT – AgriMandi.live Research

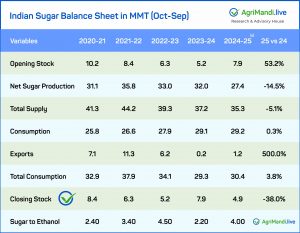

The 2024-25 sugar season in India is expected to produce 27.4 MMT of sugar, down 4.6 MMT from last season due to reduced cane yields and increased ethanol diversion. Total supply will be 35.3 MMT, with demand at 30.4 MMT, including 1 MMT for export. Lower sugar production is anticipated in major states like Uttar Pradesh, Maharashtra, and Karnataka.

In the ongoing 2024-25 sugar season, sugar diversion for ethanol production and export permissions have provided significant relief to the millers. However, net sugar production is expected to be lower by 4.6 million metric tonnes (MMT) than the previous season primarily due to a decline in cane yields across the three largest sugar producing states and an increase in sugar diversion for ethanol production than the previous year.

The 2024-25 sugar season is already midway, and according to figures from AgriMandi.live Research, India is expected to produce about 27.4 MMT of net sugar.

The ongoing season began with a carried-forward sugar stock of 7.9 MMT. Therefore, the total sugar supply in the current season is expected to be at 35.3 million tonnes (7.9 million tonnes opening stock + 27.40 million tonnes of sugar production).

When considering the total sugar consumption in the current season, the recent sugar export permission of 1 million tonnes by the government, and sugar exports under the government-to-government (G2G), the total demand/offtake, according to AgriMandi’s figure, is expected to be 30.40 million tonnes, including 29.20 million tonnes expected domestic sugar consumption + 0.20 million tonnes of G2G sugar exports + 1 million tonnes of sugar export permission.

The projected balance-sheet for the sugar market in 2024-25 indicates several important trends: a decrease in sugar production, a slight increase in consumption, and a significant rise in the conversion of sugar to ethanol.

In the 2023-24 sugar season, the total sugar availability was 37.20 million tonnes (5.20 million tonnes opening stock and 32 million tonnes of net sugar production). The total sugar consumption was 29.30 million tonnes (29.10 million tonnes of domestic sugar consumption + 0.20 million tonnes of G2G sugar exports). As a result, the ending sugar stock was 7.90 million tonnes. The sugar diversion for ethanol production in the last season was around 2.2 million tonnes.

Sugar production is expected to be lower in the current season mainly due to forecasted low output in major sugar-producing states such as Maharashtra, Karnataka, and Uttar Pradesh.

In Uttar Pradesh, net sugar production is likely to be 9.30 million tonnes, lower than the 10.40 million tonnes in the previous season. In Maharashtra, it is expected to reach 8.50 million tonnes, down from 11 million tonnes last season. The third-largest sugar-producing state, Karnataka, is also expected to see lower sugar production at 4.50 million tonnes, down from 5.20 million tonnes in the 2023-24 season.

As the government has permitted sugar export of 1 million tonnes in the current season, raw sugar prices are in disparity, while LQWs (low-quality whites) will remain in parity at $445-450 per MT for West Maharashtra and North Karnataka mills. Currently, white sugar is trading at around $486.90 per MT.

Post-allocation, as per the market sources, sugar for export trading in the Indian market ranges between Rs. 39,000 and Rs. 40,000 per tonne, with quota exchange at Rs. 3,500 per tonne benefiting sugar mills.

The domestic markets have also seen an uptick following the Indian government’s sugar export permission. In Maharashtra, sugar prices for S/30 are trading higher at Rs. 3600 to Rs. 3650 per quintal, while in Uttar Pradesh, prices of M/30 sugar ranging from Rs. 3,950 to Rs. 4,000 per quintal.

Disclaimer: The information contained herein is from publicly available data or other sources believed to be reliable and it should not be relied on as such. ChiniMandi will not be responsible in any way for any loss or damage that may arise to any person from any inadvertent error in the information contained in this news. The information given in this document is as of the date of this news and there can be no assurance that future results or events will be consistent with this information.

To read more about Sugar Industry continue reading Agriinsite.com

Source : Chinimandi