Budget 2025 highlights: No tax up to ₹12 lakh

Union Budget 2025 highlights include no income tax up to ₹12 lakh, simplification of tax structure, and significant savings for middle-income earners. Key initiatives focus on agriculture, with increased KCC loan limits and rural prosperity. MSMEs get enhanced credit guarantees, while healthcare expands with cancer care centers. Infrastructure investments and nuclear energy growth also feature prominently.

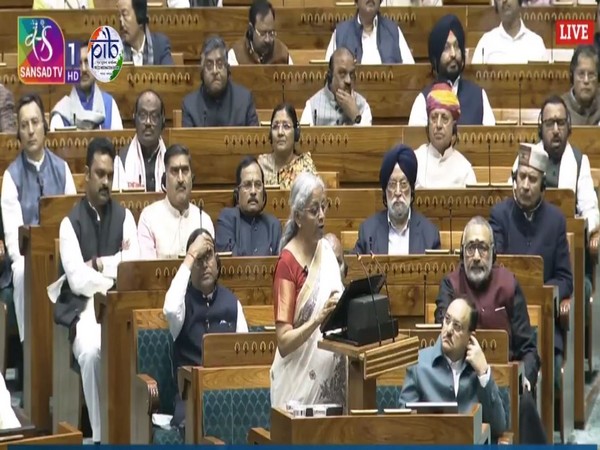

Finance Minister Nirmala Sitharaman, during her Union Budget 2025 speech, announced that no income tax will be payable on income up to Rs 12 lakh, providing significant relief to taxpayers especially the middle class.

Income Range (₹ lakh) Tax Rate

· 0–4 0%

· 4–8 5%

· 8–12 10%

· 12–16 15%

· 16–20 20%

· 20–24 25%

· Above 24 30%

Tax Benefits by Income:

₹12 lakh income: ₹80,000 saved (0% effective rate).

· ₹16 lakh income: ₹50,000 saved (7.5% effective rate).

· ₹20 lakh income: ₹90,000 saved (10% effective rate).

· ₹50 lakh income: ₹1.1 lakh saved (21.6% effective rate).

· Revenue Impact: ₹1 lakh crore direct tax revenue forgone.

New Income Tax Bill: Simplified structure with 50% fewer provisions to reduce litigation.

2. Agriculture & Rural Development

· Prime Minister Dhan-Dhaanya Krishi Yojana: Targets 100 low-productivity districts, benefiting 1.7 crore farmers.

· Mission for Pulses Self-Reliance (Tur, Urad, Masoor): 6-year plan to boost productivity, climate-resilient seeds, and farmer income.

· Kisan Credit Card (KCC): Loan limit raised to ₹5 lakh for 7.7 crore farmers, fishermen, and dairy farmers.

· Rural Prosperity Programme: Focus on skilling, technology, and reducing under-employment; Phase-1 covers 100 agri-districts.

· Makhana Board: To enhance production and marketing of makhana in Bihar.

· Western Koshi Canal Project: Benefits 50,000+ hectares in Bihar’s Mithilanchal region.

3. MSMEs, Entrepreneurship & Employment

Credit Guarantee Enhancements:

· Micro/Small Enterprises: Cover raised to ₹10 crore (additional ₹1.5 lakh crore credit in 5 years).

· Startups: Cover doubled to ₹20 crore; 1% fee for 27 focus sectors.

· Customized Credit Cards: ₹5 lakh limit for 10 lakh micro-enterprises on Udyam portal.

· Fund of Funds for Startups: ₹10,000 crore corpus.

· Footwear & Leather Sector: Aiming ₹4 lakh crore turnover and 22 lakh jobs; duty exemption on wet blue leather.

· Gig Workers: Identity cards, healthcare under PM Jan Arogya Yojana for 1 crore workers.

4. Healthcare & Education

· Cancer Care: 200 Day Care Centres in district hospitals by 2025–26.

· Customs Duty Exemptions: 36 lifesaving drugs fully exempted; 6 drugs at 5% duty.

· Medical Education: 10,000 new seats in 2025–26 (75,000 target in 5 years).

· Atal Tinkering Labs: 50,000 to be set up in government schools.

· Bharat Net: Broadband for all rural secondary schools and primary health centres.

5. Infrastructure & Urban Development

· SWAMIH Fund 2: ₹15,000 crore for completing 1 lakh housing units; 40,000 units by 2025.

· Urban Challenge Fund: ₹1 lakh crore for cities as growth hubs, water, and sanitation.

· Maritime Development Fund: ₹25,000 crore corpus for shipbuilding and port infrastructure.

· UDAN Scheme Expansion: 120 new regional connectivity destinations; 4 crore passengers targeted.

6. Energy & Environment

· Nuclear Energy Mission: ₹20,000 crore for Small Modular Reactors (SMRs); 5 operational by 2033.

· Clean Tech Manufacturing: Incentives for EV batteries, solar PV cells, and wind turbines.

· Critical Minerals: Duty exemptions on cobalt, lithium-ion scrap, and 12 others to boost domestic production.

7. Reforms & Ease of Doing Business

· FDI in Insurance: Limit raised to 100% for companies reinvesting premiums in India.

· Jan Vishwas Bill 2.0: Decriminalizes 100+ legal provisions.

· Regulatory Reforms: High-Level Committee to review non-financial sector licenses and certifications.

· Extended Deadlines: Startup incorporation benefits extended till 1.4.2030; IFSC benefits till 31.3.2030.

8. Indirect Tax Measures

· Customs Simplification: Reduced to 8 tariff rates; Social Welfare Surcharge exempted on 82 lines.

· Import Flexibility: End-use period for inputs extended to 1 year; quarterly reporting instead of monthly.

Source : Chinimandi