Season 2024-25: International Sugar Organization sees larger global deficit of 4.881 million tonnes

The ISO projects a global sugar deficit of 4.88 million tonnes for 2024-25, with production declining to 175.54 million tonnes. Consumption will reach 180.42 million tonnes, reducing stock levels. Despite supply constraints, sugar prices have fallen. Ethanol production surged, while molasses prices dropped. Global trade remains restricted, and WTO negotiations continue on agricultural policies.

International Sugar Organization (ISO) released its second revision of the global 2024-25 sugar balance.

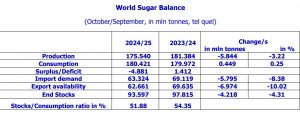

ISO’s fundamental view of the global supply/demand situation sees a larger global deficit (the difference between forecast world consumption and production) of 4.881 million tonnes (mln tonnes), up from a deficit of 2.513 mln tonnes projected in November. A global deficit of this magnitude has not been seen for nine years. World production in 2024/25 was revised to 175.540 mln tonnes, down 5.844 mln tonnes from last season. Drivers include smaller post-October 2024 production totals in major southern hemisphere producing regions, lower than expected production in India and Pakistan and a lower cane total in Thailand. World consumption is projected to reach a record 180.421 mln tonnes in 2024/25, though this forecast is 1.161 mln tonnes lower than our November estimate, leaving global consumption just 0.449 mln tonnes above last season’s total.

According to the ISO, changes in trade dynamics are key market considerations. The estimated volume of imports and exports in 2024/25 are anticipated to decline to 63.324 mln tonnes of imports, down 5.795 mln tonnes on last season and 62.661 mln tonnes of exports, down 6.974 mln tonnes on last season. The trade deficit of 0.663 mln tonnes is substantially smaller than this season’s production/consumption deficit, indicating a substantial drawdown in stocks.

A summary of our world balance projected for 2024/25 and estimated for 2023/24 is provided below.

The ending stocks/consumption ratio for 2024/25 is estimated to fall to 51.88%, from 54.35% at the end of 2023/24. The ratio is helped somewhat by the decline in projected consumption growth, the denominator in this ratio, but with stocks often held in-country for cyclical reasons, such as to satisfy off-season demand, the decline in the ratio to around the same level as the 2015/16 low is noteworthy.

In the three months since our previous Quarterly Market Outlook, in November, global sugar prices have declined. More recently, the ISA Daily Price and the ISO White Sugar Price Index for the first 19 days of February averaged USD18.79 cents/lb and USD524.36/tonne, respectively. These averages represent a recovery from the January low (USD18.00 cents/lb and USD496.38/tonne). Speculative participation in sugar has switched to a bearish net-short position, while weakness in the BRL in late 2024 and early 2025 helped lift returns for Brazilian mills hedging their exports.

Global ethanol production reached 118.5 bln litres in 2024, up substantially from 112.8 bln litres in 2023. The US achieved record output of 61.33 bln litres despite modest domestic demand growth, leveraging competitive pricing to capture unprecedented export volumes. Brazil’s fuel ethanol production soared to 33.68 bln litres, combining traditional sugarcane ethanol with rapidly expanding corn-based production, while India demonstrated remarkable growth through a strategic pivot toward grains-based production. Global consumption rose correspondingly to 117.4 bln litres in 2024, up from 109.1 bln litres in 2023, with Brazil and India increasing by 5.1 bln litres and 2.3 bln litres respectively. Looking ahead to 2025, production is projected to climb to 120.7 bln litres and consumption to 119.5 bln litres, supported by expanding blend mandates and strengthening policy frameworks across major markets.

As per ISO, molasses prices dropped sharply during the final months of 2024, primarily in reaction to lower feed wheat prices and prospects of higher molasses production in several key origins. Global production, excluding Brazil, is expected to increase by 1.3% to 50.46 mln tonnes. This is on top of the 3.5% increase in 2023. In Europe, cane molasses prices showed a decline to the lowest level since June 2022. In contrast, EU beet molasses prices rose slightly in December, having bottomed close to the EUR120/tonne mark, the lowest level since late in 2019. At these low prices, beet molasses is competitive with feed wheat values for the first time since late 2022. Global exportable supplies of molasses are restricted and will remain so in 2025. India is exporting less because of an export tax imposed in January 2024 while Russian producers continue to struggle with sanctions. Meanwhile, both the EU and US imported less in 2024. There is little expectation of volumes rising in 2025, on the back of prospects for a lower EU molasses deficit and ongoing competitive corn prices in the US limiting molasses offtake for livestock feed.

Global high fructose syrup (HFS) production is unlikely to see any significant growth in 2024, having averaged around 14.1 mln tonnes annually over the past decade. In the US, by far the globe’s biggest HFCS sector, strong exports to Mexico in 2024 compensated for weaker offtake in the domestic market. US corn wet millers have seen the net input cost of HFCS rebound in 2025, due to rising corn prices, while byproduct credits (corn oil, corn gluten feed, and gluten meal) have remained weak.

In a release ISO stated that the WTO’s chairman of the Committee on Agriculture, Ambassador Acarsoy of Türkiye, encouraged members, in his final report, to break the current stalemate in agriculture negotiations, to achieve a meaningful outcome at the MC14 gathering in Cameroon in March 2026. The Chair also called on members to engage in evidence-based discussions and text-based negotiations.

To read more about Sugar Industry continue reading Agriinsite.com

Source : Chinimandi