Kandla port congestion may cause edible oil shortage: Traders to Govt

India may face an edible oil shortage as over 150,000 tonnes of crude palm oil remain stuck at Kandla Port. Heavy congestion, triggered by a post-duty-cut import surge, has led to long vessel wait times and mid-discharge removals. Traders warn delays could extend up to 20 days, disrupting supply and raising consumer prices.

Traders have warned of edible oil shortages in local markets and supply disruptions as several vessels — mainly carrying Indonesian crude palm oil — remain stranded at Kandla Port, awaiting cargo unloading amid “heavy congestion”.

India is the world’s largest importer of palm oil, with monthly imports totalling 750,000 tonnes. Kandla is a key port that supplies major refineries catering to western and northern India.

In letters to the government, the Solvent Extractors’ Association of India (SEA), representing key stakeholders in the edible oil industry, has said that only two vessels with a combined capacity of 45,000 tonnes are currently discharging cargo, while as many as eight vessels carrying 157,000 tonnes — are waiting for berths. The congestion is particularly concerning as five more vessels, with a total capacity of 159,000 tonnes, are expected to arrive within the next week, it has said.

When contacted, Sushil Kumar Singh, Chairman of Deendayal Port Authority (DPA), Kandla, told The Indian Express: “The congestion is the result of a sudden surge in edible oil vessel arrivals after import duties were reduced in May. At present, six edible oil and six chemical vessels are waiting at anchorage. The average waiting time is 8-10 days. We’ve tightened operational protocols and are working to address the issue as efficiently as possible.”

This comes amid sharp fluctuations in palm oil prices. Traders typically increase purchases when prices drop. Last month, India’s palm oil imports hit a six-month high, driven by low domestic inventories and a favourable price gap compared to soybean and sunflower oils, Reuters reported. However, palm oil futures have since surged following the US’s proposal to raise biofuel blending mandates.

The SEA has warned that the waiting period could increase to 15–20 days, based on the expected vessel line-up. Such prolonged delays “could lead to a scarcity of edible oil in the local market, impacting the supply chain,” it has said.

“The situation has further deteriorated, as Kandla Port has resorted to pulling out edible oil vessels mid-discharge. In the past week alone, three such vessels — each with just 1,000 to 3,000 tonnes of cargo remaining — have been withdrawn or shifted from berths,” the SEA said in a letter to the Ministry of Consumer Affairs, Food and Public Distribution on June 16, following up on an earlier communication sent on June 11.

The congestion has wide-reaching implications as the extended waiting periods are incurring significant demurrage costs, thereby increasing overall import expenses and pushing up edible oil prices for consumers.

Jitendra Srivastava, CEO of Triton Logistics & Maritime, said the congestion of shipments at Kandla Port reinforces the need to upgrade India’s port infrastructure and optimise maritime logistics at the earliest.

“With vessel wait times reaching up to 48 hours, the ripple effects are felt across the entire supply chain, from exporters to consumers. As trade volumes continue to escalate, there is a pressing need for ports across the country to incorporate smart technologies, automate, and improve berthing and cargo handling capabilities to sustain future demand,” Srivastava said.

“Principal solutions include improved vessel traffic control, enhanced inter-agency coordination, and investment in technological aids such as predictive analytics to enable more effective port flow management. Upgrading berths, modernising the container terminal, and developing warehousing space are equally important to avoid bottlenecks and achieve faster turnaround times,” Srivastava said.

“As per port norms, any vessel pulled out for any reason can only be re-berthed after three days – which, in practice, can take 3-5 days — along with additional port charges for de-berthing, re-berthing, pilotage and other marine services. Meanwhile, the vessel accrues demurrage by the hour and once under demurrage, it continues to incur charges.

Ironically, this practice does little to ease the congestion,” SEA said.

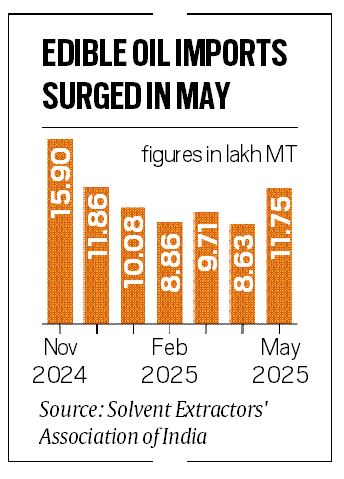

Total oil imports have fallen over the past seven months. Between November 2024 and May 2025 — the first seven months of the 2024–25 oil year — vegetable oil imports stood at 7,884,768 tonnes, down 9 per cent from 8,678,447 tonnes during the same period last year, SEA noted.

To Read more about Edible Oil News continue reading Agriinsite.com

Source : The Indian Express