Will souring sugar stocks turn the tide?

Despite a sector-wide slump, select sugar stocks like EID Parry and Balrampur Chini outperformed, backed by strong ethanol prospects and sound financials. India’s bumper sugar production forecast and ethanol blending drive offer long-term growth. Yet, rising inventories, stagnant ethanol prices, and policy clarity remain crucial for sustained sectoral momentum.

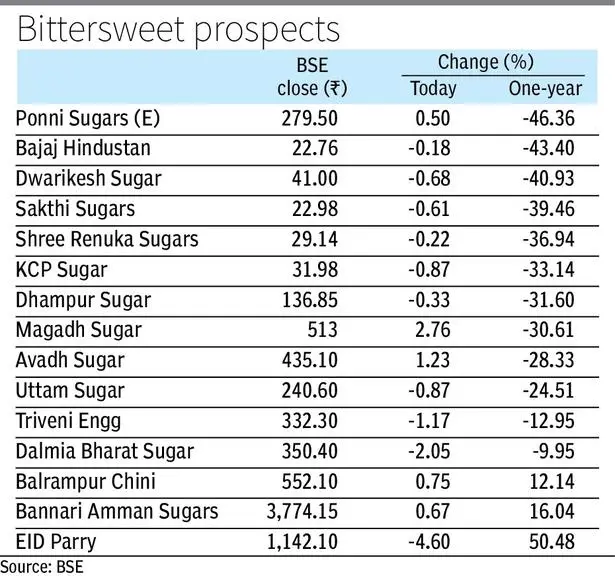

Shares of sugar companies have been on the downtrend in the last one year amid fear of supply glut and volatile market. Some of the stocks have fallen nearly 50 per cent in the last one year.

However, a few such as EID Parry delivered a return of nearly 51 per cent, Bannari Amman Sugars 16 per cent and Balrampur Chini Mills jumped over 12 per cent outperforming the Nifty 50’s 5 per cent gains. These companies have defied the broader sector slump, thanks to their diversified revenue streams, flexible distillery set-ups, low debt and strong financials. Industry analysts see some positives going forward amidst challenging times for the sector.

The global sugar market, entering mid-2025, is experiencing an inflection point defined by strong production in India and Brazil, changing consumer preferences and the accelerating momentum of ethanol-blending programmes. After a period of relative price stability in Q2 2025, recent weeks have seen global raw sugar prices moderate as robust supply from major origins coincides with a tepid uptick in global demand.

India, on track to achieve a 12 per cent ethanol-blending rate by 2024-25 (targeting 20 per cent by 2025-26), is sustaining its dual role as a sugar powerhouse and a rising green fuel producer. Domestic sugar consumption in India remains high but efficiency gains and climate-adaptive practices are gradually offsetting the risks from erratic weather and policy shifts, says a note from CMB News.

Prices of the sweetener are set to rise despite a higher output projection by industry bodies. With climbing demand due to the upcoming festival season and the likelihood of improved margins for sugar companies will have a positive impact on the sugar stocks. As such, shares of most sugar companies, the second largest agro industry, showed a positive bias. The Centre’s push towards ethanol blending, too, lends support for the uptick in sugar stocks.

Production up

India is the second-largest producer of sugar in the world after Brazil. The majority of the sugar used in India is made from sugarcane. The erratic nature of sugar output, which is dependent on weather, directly impacts the price of sugar. Other factors that determine the price movement are the government’s policy on sugar exports, freight subsidy and pricing.

India’s sugar production is projected to surge to 34.90 million tonnes (mt) in the 2025-26 season, marking an 18 per cent increase, according to Indian Sugar Mills Association, an apex trade body. This boost allows for potential exports of 2 mt. A significant 5 mt of sugar could be diverted for ethanol production, while domestic offtake is pegged at 28 mt.

Ample supplies from top sugar producers Brazil, India and Thailand have dragged the global futures prices down. “India may allow local sugar mills to export sugar in the season that starts in October, as early signs point to a bumper sugarcane crop. That prospect has helped push prices lower in recent trading sessions,” according to StoneX analyst Lucas Fonseca.

The current monsoon season has seen above-average rainfall, spurring plantings. With sugarcane acreage expanding in key producing States like Maharashtra and Karnataka, the National Federation of Cooperative Sugar Factories has forecast a 19 per cent increase in production in 2025-26.

Striking gold with ethanol

Going forward, ethanol is set to become the money spinner for most of the sugar mills. Ethanol is a biofuel produced naturally through the fermentation of sugars by yeast. It is used in the production of drugs, plastics, polishes and cosmetics, and also as an alternative fuel source. It is the latter that is going to bring a windfall for the sugar makers.

Shruti Jain, Chief Strategy Officer, Arihant Capital Markets, told businessline that while higher ethanol diversion supports long-term growth, auto majors have flagged concerns like minor mileage dips (1-3 per cent) and corrosion risks, especially in older vehicles. However, with a shift towards E20-compatible vehicles, the sector is well-positioned for structural growth. “Select integrated sugar companies with strong ethanol capacities could benefit the most from this transition,” she added.

“Since April 2023, automakers have rolled out E20 compatible engines, mitigating long-term risks. Ethanol’s lower calorific value does impact mileage marginally; however, the structural shift toward flex-fuel and higher blend adoption ensures consistent demand for ethanol. For the sugar sector, this translates into a sustainable revenue stream from ethanol diversion, enhanced margin visibility and insulation from global sugar price volatility. Overall, ethanol integration remains a long-term structural tailwind for the industry despite near-term apprehensions,” said Saurav Chaube, Research Analyst, SAMCO Securities.

Mixed outlook

The Indian sugar industry faces a complex outlook despite projections of higher production, driven by strong pre-monsoon showers, improved yields and effective disease management.

However, Chaube, on a cautious note, said that structural challenges such as elevated inventory levels and stagnant sugar MSP persist which are squeezing mill margins. Ethanol economics are also strained since ethanol prices have remained stagnant for the past three years impacting margins and profitability. Policy support through higher MSP, revised ethanol pricing and a 2-mt export allowance is critical to prevent domestic price pressures.

At the current juncture, increase in ethanol price is the most important lever to improve profitability as this will lead to more diversion of sugarcane-based feedstock, lower sugar production and consequently, higher sugar prices as well, said Elara Securities. “Currently, we have a neutral view on the sector as we await policy triggers to fructify. Balrampur Chini is our top pick in the sector,” the domestic brokerage said.

While El Nino was a factor in the previous season (2023-24), impacting production due to reduced rainfall and groundwater availability, the 2024 monsoon and normal to above-average monsoon so far in 2025, are likely to have a positive effect on the upcoming season. The stronger monsoon has replenished water resources and encouraged farmers to expand cultivation of this cash crop. Key risks include the upliftment of curbs on ethanol import as part of US-India Trade Talks and price pressure unless export programmes allowed or other balancing measures are taken.

To Read more about Sugar Industry continue reading Agriinsite.com

Source : The Hindu Business line