Global rice prices likely to decline on abundant supplies despite crop loss in India, Pakistan

Global rice prices are expected to remain weak despite crop losses in parts of India and Pakistan, as abundant supplies—especially from India—keep the market bearish. BMI cut its 2025 CBOT rice futures forecast to \$12.8/cwt from \$13.9/cwt. USDA projects record stocks, higher production in Brazil and Colombia, and softer global demand.

Rice prices in the global market will likely decline, notwithstanding the loss to the paddy crop in some regions in India and Pakistan. Analysts say this is mainly due to abundant supplies in growing countries, particularly India. Rice prices are currently ruling at an 8-year low.

However, research agency BMI, a unit of Fitch Solutions, said in the short term, the main risk is that “a particularly strong Indian monsoon season” could damage the country’s rice crop. “While expectations for above-average rainfall have been met, we note that there could be areas where rainfall was too abundant and could ultimately end up weighing on the size of the harvest,” it said.

According to the US Department of Agriculture (USDA), global rice production will be higher due to increased production in Brazil and Colombia. “Global trade is forecast to be lower with decreased exports from India and Pakistan. Global consumption is forecast to be lower, primarily in Burma and the United States. Global ending stocks are forecast higher with increases for India and Pakistan,” it said in its Grains: World Market and Trade report released during the weekend.

Price forecast cut

The United Nations’ Food and Agriculture Organisation (FAO) said wheat and rice export prices dropped to their lowest levels in years in August, largely due to abundant global supplies and weak demand. FAO’s Agricultural Market Information System (AMIS) said global rice production in 2025-26 (September-August) will likely be higher at 555.4 million tonne (mt) compared with 549.9 mt a year ago.

BMI said: “We are making a downward revision to our price forecast for CBOT-listed, second-month rice futures for 2025, from $13.9/cwt (45.35 kg) to $12.8/cwt.”

The research agency said the main driver of its bearish expectations continued to be the expected abundant supplies, particularly in India, the largest exporting market. “On a global level, we expect production to increase by 0.4 per cent year-on-year, outpaced by the growth in consumption by 1.8 per cent year-on-year, resulting in a continued, albeit smaller, market surplus,” it said.

According to the Food Corporation of India, rice stocks in the country as of September 1 were 37.97 mt, besides 21.35 mt of unmilled paddy (14.5 mt of rice when processed), the highest on record, in its warehouses.

Indian prices stable

The FAO said the all rice price index dropped 2 per cent in August at 101.4 points compared to July. The index was down 24.3 per cent year-on-year. Prices in Vietnam declined due to weak demand, while Thailand lowered its prices, and the US and Pakistan also joined the nations in lowering rice prices.

Indian white rice prices were stable on demand from Africa, while basmati gained on lower inventories and hopes of sales to Iran, which is set to lift the seasonal curbs on imports. FAO said Indian Pusa basmati ruled at $925 a tonne, while Pakistan’s basmati quoted at $1,064.

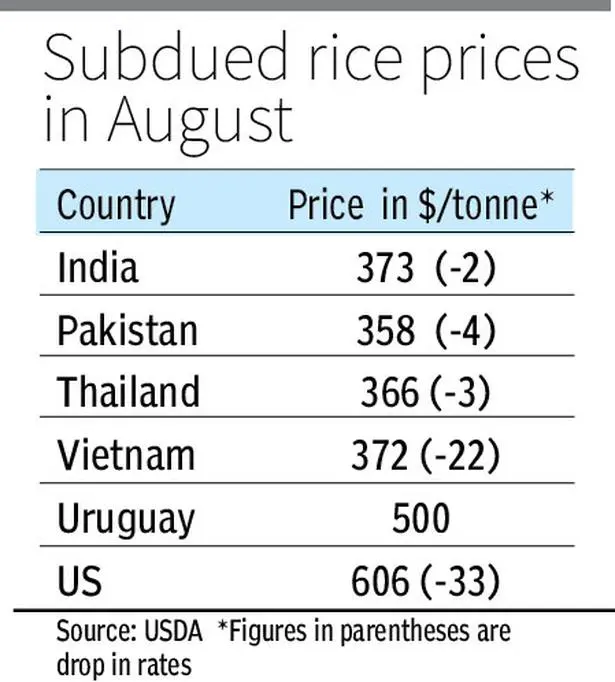

The USDA said that since August, global export prices have declined for all nations, except for Uruguay. “US quotes fell $33 to $606/tonne amid the ongoing harvest. Uruguayan prices were unchanged at $500, reflecting strong demand. India quotes ($373) decreased $2 on weaker global demand. Vietnamese quotes ($372) decreased $22 following the temporary ban on Philippine rice imports. Thai quotes dipped $3 to $366 to garner more demand from importers. Pakistani quotes dropped $4 to $358 on weak interest from major markets,” it said.

Signs of price weakness

“It is our view that the rice market will remain in surplus through the remainder of our forecast period out to 2028-29, while noting that unfavourable weather conditions in major producing markets remain a risk and would result in decreased production in specific seasons,” said BMI.

“The latest closing price recorded on September 9 was $11.6/cwt, equivalent to a 9.7 per cent month-on-month decrease and a 20.9 per cent year-on-year decrease. The price was the lowest recorded since July 2020, and in the year-to-date up to September 9, prices have decreased by 17.5 per cent,” the research agency said.

Following a period of elevated prices in the first half of 2024, largely driven by export restrictions imposed by India, the market has been steadfastly bearish over recent months, said BMI.

Pointing to data from the US CFTC Commitment Of Traders Report, the research agency said the latest recording from September 2 pointed to a net short position of 6,138 contracts. “The last net long position held by money managers was recorded on June 4, 2024, indicative of continued expectations for price weakness,” it said.

Output to top demand

BMI said its Indian rice production forecast for 2025-26 pointed to a smaller increase of 0.5 per cent year-on-year up to 151 million tonnes (mt), a record harvest. It highlighted the ongoing oversupply in the market and reinforced its expectations for muted prices through the end of the year and into 2026.

It said the 2025-26 season will be the third consecutive season with production levels being above consumption. BMI forecast global production will increase to 542 mt, consumption will increase to 539.4 mt, and the market balance will decrease from 10.2 mt to 2.6 mt.

“We expect consumption to increase by a greater magnitude than production, driven both by normal demand gains associated with population growth and urbanisation, as well as the sharp decline in rice prices over recent months,” said the research agency.

However, it said given that India accounts for around 25 per cent of the global production and around 35 per cent of exports in the world, any developments in this market are particularly risky for prices. “We flag the overreliance on the country’s harvest as a risk, making them particularly vulnerable. Looking ahead to 2026, we highlight that the smaller market surplus for the 2025-26 season also presents downside risks for the market and could temper bearish sentiment,” said BMI.

As the surplus is relatively small, the market is more exposed to a potential support for prices if expectations for the 2025-26 season were to deteriorate or forecasts for the 2026-27 season were to be for a small harvest.

“In line with this, we note that beginning stocks in 2026-27 are forecast to be down on a global level by 0.3 per cent year-on-year, with a 1.1 per cent year-on-year decrease in India and 11.5 per cent year-on-year decrease in the US,” said the research agency.

To Read more about Rice News continue reading Agriinsite.com

Source : The Hindu Business line