UK headline inflation rate easing but sugar, rent, insurance surging

By Eamon Akil Farhat

Britain’s main inflation rate is easing, but some items in the basket of goods that consumers buy are still rising sharply, contributing to a spiral that the Bank of England wants to choke off.

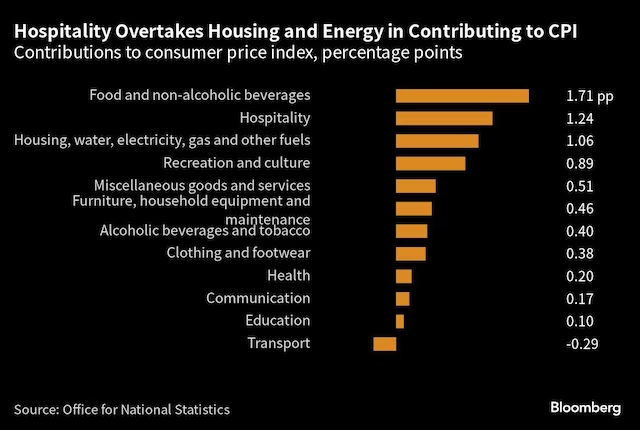

Official statistics showed the Consumer Prices Index slid to 6.8% last month from a four decade peak of 11.1% late last year. Fuel prices have retreated since the crisis that sparked the current round of inflation last year, but some categories like food, hospitality and home rental costs still are feeding upward momentum in prices.

The result is that inflation remains well above the BOE’s 2% target and has come in stronger than economists expected in five of the past six months. That will add to pressure for higher interest rates. BOE Governor Andrew Bailey earlier this month warned borrowing costs will have to remain “sufficiently restrictive for sufficiently long” to bring inflation back down.

Following are charts showing the factors guiding the UK’s inflation figures: