Aelea Commodities Limited IPO subscribed over 5 times on Day 1, retail investors lead bidding

Aelea Commodities Limited’s SME IPO saw a strong response on its first day, subscribed 5.01 times. Retail investors led the charge, subscribing 8.08 times, followed by non-institutional investors at 4.54 times. The QIB portion remained unsubscribed. The IPO offers 5,368,800 shares, with a price band of ₹91-95. Proceeds will fund a new manufacturing unit, facility upgradation, and general corporate purposes. Listing is expected on July 22, 2024.

On the first day, the SME initial public offering of Aelea Commodities Limited engaged in agricultural commodities saw a good response. The subscription period opened on Friday, July 12, 2024, and will closed on July 16, 2024.

Aelea Commodities offers a total of 5,368,800 shares. The Gujarat-based firm reserved 1,785,600 shares for retail investors at 33.26 per cent, 765,600 for non-institutional investors (NIIs) at 14.26 per cent, and 1,020,000 shares for qualified institutional buyers (QIBs) at 19 per cent in the public issue. Another 1,528,800 shares were reserved for anchor investors at 28.48 per cent.

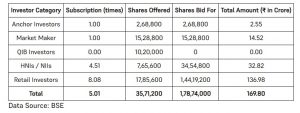

The IPO was subscribed to more than five times on the first day at 5.01 times. It is the retail investors who became the most enthusiastic participants with their part subscribed more than eight times at 8.08 times. Even the portion reserved for NIIs was received well and subscribed more than four and a half times at 4.54 times. On the opening day itself, though, the QIBs portion remained unsubscribed. Strong demand saw more than 1.78 crore share applications received against the offered 35.71 lakh shares on Friday.

The Aelea Commodities IPO price band has been pegged at ₹91 to ₹95 per equity share. It expects to mop up ₹51.00 crore through this fully fresh issue o aroundf 53.69 lakh equity shares. The minimum investment asked by retail investors has been pegged at ₹114,000 for a lot size of 1,200 shares.

The proceeds from the IPO would be utilised for setting up a new manufacturing unit with a plant and machinery, upgradation of an existing facility, and general corporate purpose.

Ekadrisht Capital Private Limited is the Book Running Lead Manager to the Issue, and Maashitla Securities Private Limited is the Registrar. Hozefa S Jawadwala, Satyanarayan Patro, Ashok Patel, and others are promoters of the company.

Aelea Commodities processes and trades cashews, but its major agricultural commodities are sugar, soybean, rice, pulses, and wheat flour. Its processing unit is based in Surat, Gujarat, while another one is underway in the same district.

It has shown improved financial performance, with a net profit of ₹ 12.22 crore on revenues of ₹ 144.50 crore in 2023-2024. This is a huge growth over the net profit of ₹ 1.91 crore on revenues of ₹ 110.14 crore in the previous year.

Established in 2018, Aelea Commodities Limited specializes in trading and processing agricultural products, with a primary focus on cashews. The company also deals in other commodities such as sugar, pulses, soybeans, rice, and wheat flour.

Based in Surat, Gujarat, Aelea Commodities imports raw cashew nuts from Senegal, Côte d’Ivoire, Tanzania, Benin, and Burkina Faso in Africa.

In India, Aelea Commodities serves clients in Rajasthan, Karnataka, Gujarat, and Maharashtra, while internationally, it caters to customers in Dubai and Sri Lanka.

Source Link : https://www.chinimandi.com/aelea-commodities-limited-ipo-subscribed-over-5-times-on-day-1-retail-investors-lead-bidding/