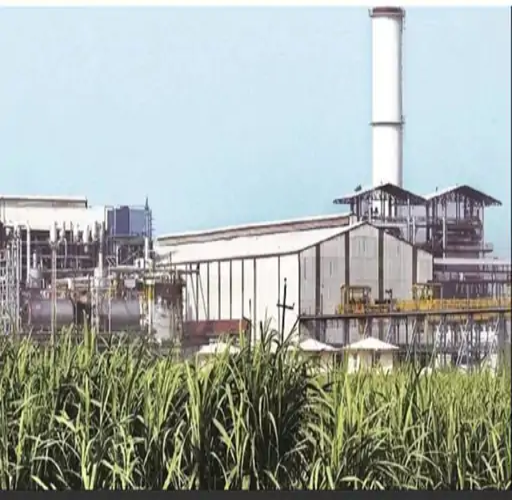

Balrampur Chini share price at 52 week high as sugar producers remain in focus on improved earnings prospects

Balrampur Chini Mills share prices that have gained more than 15% in November also scaled 52-week highs on Thursday. Stocks of sugar companies remain in limelight with rising sugar prices amidst favorable demand supply dynamics and rising ethanol production. Triveni Engineering and Industries and Bajaj Hindusthan Sugar Ltd shares are also trading close to 52-week highs seen in October and November respectively.

The sugarcane crushing season that starts from 1st October has now caught full momentum. Avantika Saraogi Promoter of Balrampur Chini Mills speaking on CNBC TV-18 said that the Balrampur Chini Mills is geared up for a very positive season ahead and it expects a 10% rise in cane availability with better yields and recovery. This year sugar is the flavor as prices are good and Saraogi said that they expect production of 30 (million Tonne) this year versus 28 mt consumption.

It is not surprising that the sugar prices in the country remain firm and analysts expect firm sugar prices resulting in strong earnings growth in FY24 and FY25.

The rising ethanol production is another reason that has lifted sentiments and earnings outlook for Sugar producers as their cash flow cycle also has improves

Saraogi in the television interview had said that Balrampur Chini Mills will be maintaining a 33:66 ratio for Ethanol to sugar this year. There will be 50% higher production of ethanol this year as the new capacity added will help the company see higher growth. In future as per cane availability in their area- the company will look for organic opportunities.

Triveni Engineering with ethanol capacity expansion to be completed soon will also see benefits accrue feel analysts.

The UP based Sugar producers such as Balrampur Chini Mills, Triveni Engineering and others as Dwarikesh Sugar Industries and Dalmia Bharat Sugar remain better placed compared to peers in other states. The other two key sugar producing states, Karnataka and Maharashtra are likely to see lower sugar production and yields.

Analysts at DAM Capital in their report said that they believe sugar production in Maharashtra and Karnataka would be down by 25% for the full 2023-24 season largely due to reduced sugarcane yields and lower sugar recovery. With completion of sugar production in these states in February 2023, sugar prices are likely to inch up beyond Rs40/kg. The irregular rainfall has also impacted sugarcane sowing in these southern states, which could adversely impact sugar production in the 2024-25 season, they added.

The analysts at DAM Capital believe UP-based sugar companies would be the major beneficiary of higher sugar prices, considering higher sugar production in the state, improvement in recovery rates and extensive utilisation of distillery capacity by the UP-based sugar mills such as Balrampur Chini, Triveni Engineering.

They maintain positive outlook on the sugar sector driven by the strong pricing scenario, providing a favourable perspective for at least one year and continue to maintain their bullish stance on Balrampur Chini, Triveni Engineering and Dalmia Bharat Sugar.

Balrampur Chini is likely to see 10% higher sugarcane crushing along with 10-15 basis points improvement in sugar recovery in the 2023-24 season as per analysts.

Triveni Engineering as per analysts would complete its distillery expansion in Q4, and it is likely to utilise its distillery capacities through B-heavy molasses and grain feedstock.