Brazil’s Second Corn Harvest Expected at Record 123 MMT

Brazil is set for a record corn harvest in 2025 due to favorable weather, especially in Mato Grosso. However, delayed harvesting, weak export demand, and rising domestic consumption—driven by livestock feed and expanding corn ethanol production—are likely to reduce exports by 9%. Infrastructure strains and low prices also challenge farmers despite the bumper crop.

“Good weather conditions, particularly abundant rains throughout April and May, helped yields in many key growing states, Agroconsult said,” according to Mano’s reporting. “The new forecast represents an increase of 10.4 million tons over a May estimate by Agroconsult, and is 20.2 million tons above last season’s output, the consultancy said. In Mato Grosso, Brazil’s biggest farm state, the average yield stood at 131.9 bags per hectare, up almost 12% from the previous year, according to Agronconsult data.”

Harvest Has Been Delayed by Wet Weather

Brownfield Ag News’ Mark Dorenkamp reported on June 17 that “Brazil remains on track to produce a huge corn crop despite harvest delays. Market analyst Michael Cordonnier with Soybean and Corn Advisor says Safrinha corn is five percent harvested compared to 21 percent a year ago.”

“‘And the reason is there’s been a lot of late season rains in Brazil, much later than normal, so the crop is still very high in moisture. And very few farmers have on-farm storage, much less drying facilities,’” Dorenkamp reported. “He tells Brownfield Brazilian farmers don’t have to worry about stalk quality like growers in the U.S. as corn dries down naturally.”

‘”The rain is beneficial for the yields of course, it just slows down initial harvest. And multiple states in Brazil are expecting record Safrinha corn yields,’” Dorenkamp reported. “Cordonnier is forecasting Brazil’s second crop corn at a record 130 million tons.”

In addition, Mano reported that “harvesting such a large crop poses challenges. Agroconsult said that removing the massive crop from fields will weigh on Brazil’s infrastructure. Additionally, unattractive prices and the slow pace of sales, particularly in export markets, are worrying some farmers.”

“Pessoa said China has been ‘out of the market for some time’ while important buyers of Brazil’s corn, such as Iran and Egypt, face regional conflicts, potentially hurting Brazil’s exports this year,” Mano reported. “Competition from rivals like Argentina and the U.S., which will harvest some 400 million tons, may also be a problem, Agroconsult said.”

Exports Expected to Decline

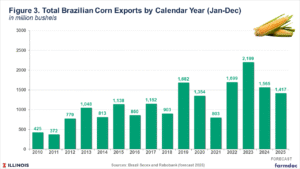

Farmdoc daily‘s Joana Colussi, Gary Schnitkey, and Nick Paulson reported at the beginning of June that “despite a larger harvest, Brazil’s corn exports in 2025 are projected to decline compared to last year. From January to December, exports are forecast by Rabobank at 1,417 million bushels—a 9% drop from the 1,516 million bushels shipped during the same period in 2024. The main drivers of this decline are rising domestic demand from the livestock sector and the growing corn ethanol industry in Brazil, which has expanded significantly over the past decade.”

“In 2024, Brazil recorded all-time highs in cattle, chicken, and pig slaughter, fueled by corn-based animal feed. Conab estimates that 3,516 million bushels of corn from the 2024–25 crop will be consumed domestically in Brazil throughout 2025—a 6.3% increase compared to the previous season,” Colussi, Schnitkey and Paulson reported. “Of this total, the animal protein industry is expected to account for about 70% of consumption, while the ethanol industry will use around 15%. The remainder will go to seed production and food industrial uses.”

“Brazil, the world’s second-largest ethanol producer behind the United States, has seen a significant expansion of corn-based ethanol processing plants across the Center-West states—a region where second-crop corn production has grown rapidly over the past decade,” Colussi, Schnitkey and Paulson reported. “Brazil currently has 25 operational corn ethanol plants, with another 15 under construction, according to data from the Brazilian National Agency of Petroleum, Natural Gas and Biofuels.”

To Read more about Maize News continue reading Agriinsite.com

Source : Farm Policy News