Egypt’s wheat flour export collapse in 2025

Egypt’s wheat imports have declined in 2025 after a policy effectively halted flour exports, disrupting milling demand and supply chains. Russia’s market share fell as Ukraine’s rose, amid certification disputes. Meanwhile, Turkey faces high inflation, financing pressures, and lower wheat yields, likely reducing flour exports despite remaining a dominant regional supplier.

At the International Grain Forum’s “Turkey & Egypt Grain Outlook” webinar held on October 27, 2025, market experts painted a vivid picture of two neighboring grain powerhouses facing contrasting realities. While Turkey continues to battle inflation and financing bottlenecks, Egypt’s grain sector is grappling with policy-induced distortions that have abruptly halted flour exports and reshaped its wheat timport dynamics.

Moderated by Vlado Kovačević, Director of the Commodity Exchange Novi Sad, the online event featured two seasoned industry figures: Hesham Soliman, President of Mediterranean Star for Trading (Egypt), and İzzet Alev, Managing Director of BA Ticaret (Turkey).

In his presentation, Hesham Soliman offered a data-rich overview of Egypt’s wheat, corn, and soybean markets, highlighting both structural progress and new constraints. Egypt remains one of the world’s largest grain importers, sourcing around 28 million tonnes annually — equivalent to nearly half of the MENA region’s total grain imports. Driven by population growth (112 million residents), 15 million tourists, and over 10 million refugees, the country’s consumption keeps rising. Yet, despite this strong underlying demand, 2025 has brought an unexpected contraction in wheat imports — and the reason lies in a sharp reversal of export policy.

FROM EXPORT BOOM TO SUDDEN HALT

In 2024, Egypt recorded a record-high 1.75 million tonnes of wheat flour exports, mainly to African and regional markets. These shipments relied on around 2 million tonnes of wheat drawn from domestic and imported stocks. However, in May 2025, the government imposed a new decree requiring any company wishing to export wheat flour or pasta to present a 100% pre-paid SWIFT transfer from the buyer before customs clearance. “From my point of view, it’s practically a ban,” Soliman said. “Who will pay 100% upfront for flour when competitors like Turkey can ship on cash-against-documents terms?” The result was immediate. Flour exports fell to zero, removing an entire segment of demand from Egypt’s milling sector and dragging down overall wheat import needs.

According to Soliman, nine vessels consigned to Egypt’s Mustaqbal Misr agency have also been stuck at ports due to delayed payments — further disrupting supply chains and pressuring prices.

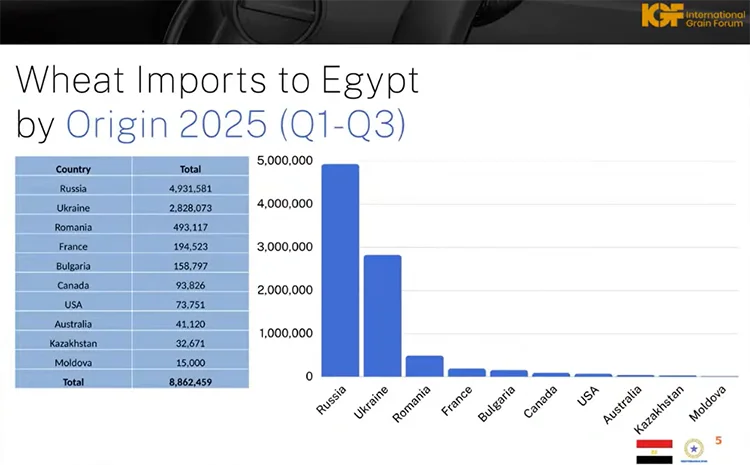

DOMINANCE SHIFTS IN SUPPLY ORIGINS

Russia remains Egypt’s primary wheat supplier, but its share has fallen from 74% in 2024 to 55% in 2025, while Ukraine’s share jumped from 15% to 32% by the end of September. Soliman attributed the shift to both pricing dynamics and evolving logistics amid the ongoing Black Sea conflict. Yet, he also warned of emerging complications:

In August and October, the Ukrainian embassy in Cairo sent formal complaints to Egypt’s government, alleging that Ukrainian-origin cargoes were being re-exported under Russian certificates of origin. The Central Bank of Egypt subsequently launched an investigation, suspending several importers. “Market uncertainty is high,” Soliman noted, “but we expect stability to return in a few weeks. Total wheat imports will likely close the year at around 12.5–12.7 million tonnes.”

CORN AND SOY: PRIVATE-SECTOR RESILIENCE

Corn and soybeans, both privately managed commodities, continue to provide stability to Egypt’s feed and crushing industries. Corn consumption stands at 16–18 million tonnes annually, with imports covering roughly 9–10 million tonnes. Brazil remains the top supplier (52%), followed by Argentina (23%) and Ukraine (13%). Soybean imports are accelerating again — expected to exceed 4 million tonnes by end-2025 — with U.S. origin dominating (78%) thanks to superior quality and crushing efficiency. However, both sectors remain affected by the foreign currency constraints that have plagued Egypt’s banking system since 2023.

TURKEY’S CHALLENGES: INFLATION, COSTS, AND EXPORT PRESSURE

Representing the Turkish market, İzzet Alev, Managing Director of BA Ticaret, offered a comparative perspective. Turkey, the world’s largest wheat flour exporter, and among the top importers of milling wheat, continues to play a pivotal role in regional grain processing and re-exports. But the Turkish grain industry faces severe financing costs (around 39%), 33% inflation, and a declining domestic wheat yield — down from 21 million tonnes in 2023 to 17 million tonnes this year, largely due to climate stress.

The Turkish Grain Board (TMO) continues to regulate prices through intervention purchases and import licenses, ensuring exporters can access raw wheat duty-free if they export processed flour. Still, Alev warned that flour exports may fall by 20–25% this season, pressured by financing burdens and Red Sea disruptions. “We are fighting inflation and high costs while still trying to remain competitive in export markets,” Alev said. “But challenges keep us motivated.”

REGIONAL COMPETITION INTENSIFIES

Iraq remains Turkey’s largest flour export destination, though exporters face new barriers ranging from 100% to 120% import duties. These restrictions — described by Alev as “import barriers rather than pure duties” — have significantly slowed exports to northern Iraq.

To maintain access to key markets, Turkish traders are increasingly turning to overland routes through Syria, which is emerging as the next growth corridor for Turkish flour. “We expect Syria to be the next big destination for Turkish flour,” Alev said, noting that some exporters are now redirecting cargoes via Damascus and Baghdad to bypass customs challenges at the northern Iraqi border.

During the discussion, Alev also acknowledged Egypt’s short-lived rise in regional flour exports in 2024, which had surprised Turkish millers. Hesham Soliman clarified that Egypt has since halted all flour exports, effectively leaving Turkey once again as the dominant regional supplier.

To Read more about Wheat News continue reading Agriinsite.com

Source : Ukr Agro Consult