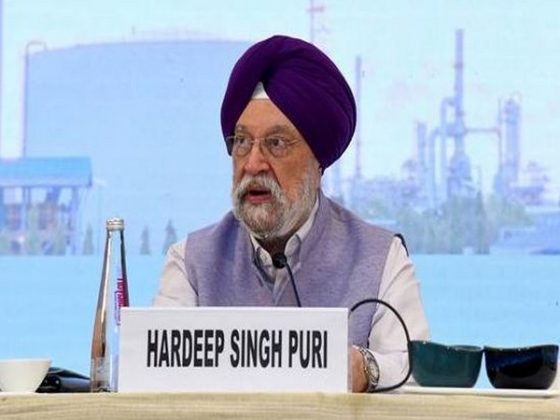

Hardeep Singh Puri calls to build consensus over bringing petrol, diesel under GST

Union Minister Hardeep Singh Puri emphasized building consensus on bringing petrol and diesel under GST during a lecture on energy security. He noted India’s significant energy consumption and the need to boost exploration and strategic reserves. While advocating for GST inclusion, Puri highlighted opposition from non-BJP states due to the importance of fuel taxes for state revenues. He also addressed the challenges of energy availability, affordability, and the shift to renewables, including green hydrogen, as key to India’s future energy landscape.

Union Minister for Petroleum and Natural Gas Hardeep Singh Puri on Friday called to build consensus over bringing petrol, diesel under the Goods and Services Tax.

While delivering a lecture on “Strategy and Measures for Enhancing India’s Energy Security in the Coming Decade” at the Pune International Centre’s (PIC) 14th Foundation Day lecture, he said, “I have heard a suggestion to bring petrol and diesel under GST, now petrol and diesel under GST is something that I have been advocating for a long period of time. Now I am very sure that my senior colleague, the finance minister, has also spoken about bringing fuel under GST on several occasions.”

To enhance its energy security, India needs to focus on strategic petroleum reserves and prioritise exploration and production to reduce its heavy reliance on imported fuel.

Puri highlighted that with a population of 1.4 billion and energy consumption projected to be three times the global average, India is positioned to be a key player in the global energy landscape. Over the next two decades, he noted, India is expected to contribute to 25 percent of the world’s increase in energy consumption.

Puri emphasised that achieving this requires unanimous approval from all states and acknowledges the challenges in getting states on board, as petrol and diesel are significant revenue generators for them.

In fact, he pointed out that states are unlikely to agree to this move, as liquor and energy are major revenue sources.

To make this happen, the states need to initiate the process, and the central government is ready to cooperate. Puri highlighted that the Kerala High Court had suggested discussing this issue in the GST Council, but the finance minister of Kerala didn’t agree.

He said that non-BJP states are not willing to forego the additional VAT.

“The Kerala High Court, if I remember last year, had suggested that the GST council should take this up as in its agenda, and my recollection is that in a meeting in Allahabad, it came up in the meeting also , but as you know, the GST council works on the principle of consensus and unanimity and the state chief ministers have to agree. We are currently in the situation that BJP-ruled states have reduced their VAT, and non-BJP states are not even willing to forego the additional VAT, so I do not see that it is happening,” he added.

Reflecting on India’s long history in oil exploration, dating back to the discovery of crude oil in Digboi, Assam, in the 1880s, he said the government’s clearance for the exploitation of one million square kilometres of sedimentary basin sends a positive signal to investors.

He identified three primary challenges to energy security: availability, affordability, and the transition to renewable energy sources. Puri also mentioned that while green hydrogen represents the fuel of the future, its success depends on local demand and production, and that technological advancements could help overcome associated cost challenges.

On global oil markets, he noted that there is no shortage of oil globally, but rising geopolitical tensions could lead to increased oil prices. He added that traditional oil cartels will have less influence as new energy sources emerge.

In his closing remarks, Dr Raghunath Mashelkar, President, PIC, reiterated the importance of reducing India’s fuel import bill and advancing renewable energy initiatives.

Source Link : https://www.chinimandi.com/hardeep-singh-puri-calls-to-build-consensus-over-bringing-petrol-diesel-under-gst/