India’s edible oil stocks fall to five-year low on weak palm oil imports

India’s edible oil stocks hit five-year low at 1.35 mt on May 1, 2025 amid a sharp fall in April palm oil imports, down 24% month-on-month. Despite low stocks, domestic supply remains stable due to active mustard seed crushing. CPI-based edible oil inflation soared to 17.4% in April. Weak oil meal demand is also pressuring millers to maintain higher retail prices.

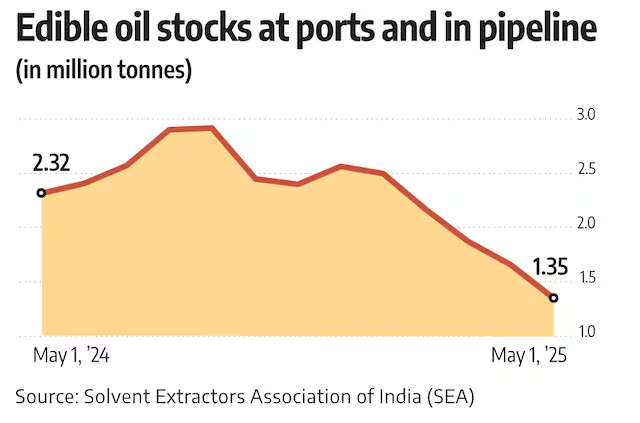

India’s edible oil stocks in ports and pipelines dipped to a five-year low of 1.35 million tonnes (mt) as on May 1, 2025, due to a sharp drop in April palm oil imports that fell to their lowest in four years, data from the Solvent Extractors Association of India (SEA) showed.

The last time India had lower than May 1, 2025 stocks in ports and pipelines was back on 1 May 2020, when it had stocks of around 0.91 mt.

Depleted stocks may mean India will increase imports of palm oil and soyoil in the coming months, supporting Malaysian palm oil prices and US soyoil futures, news agency Reuters said.

India’s palm oil imports in April fell by 24.29 per cent from March to 321,446 tonnes, the SEA said.

“Low stocks do not mean that edible oil supplies are inadequate in the country. Stocks and imports have also dropped as mustard seed crushing is going on in full swing in the country, which is why domestic supplies are good,” said BV Mehta, executive director of SEA.

Mehta added that port stocks have also dropped as every month around 60,000-70,000 tonnes of refined edible oils are imported from Nepal.

The low stocks and low imports have come at a time when edible oil inflation in April 2025 as measured by the Consumer Price Index (CPI) had soared to 17.4 per cent, marking the sixth successive month of double-digit inflation — a pace not seen since March 2022, when the Russia-Ukraine conflict had just begun.

“The high edible oil prices are due to the fact that the landed price of crude palm oil in Mumbai ports, which is the benchmark, is still at around $1,100 per tonne, though it has softened since March,” Mehta said.

Last year, during the same time, the landed price of crude palm oil was less than $1,000 per tonne.

He said another reason for the high retail price of edible oils is that oil meals demand from the livestock industry has gone down, which is why millers are not able to bring down the retail price of edible oil.

“When a miller crushes oilseeds, he gets his revenues from selling edible oils and oil meals (to the livestock sector). Now when demand for one (oil meals) has gone down sharply, the pressure is on the other to compensate for the falling margins,” a trader said.

Oil meals demand from the livestock industry has come down due to high supply of DDGS (Distiller’s Dried Grains with Solubles), which is a by-product of ethanol production. With India producing over 5 billion litres of ethanol, the production of DDGS has gone up manifold.

“Rapeseed meal and rice bran meal are used for cattle feed while soymeal is used by the poultry sector. Demand for all of them has gone down due to DDGS,” Mehta said.

To Read more about Edible Oil News continue reading Agriinsite.com

Source : Business Standard