Rain carries corn higher, weighs on wheat

Soybean futures rose after Argentinian strike conclusion; wheat mixed, corn up on planting delays. US crude oil prices declined amid stockpile surge, ceasefire hopes, and Fed rate decision. DJIA dropped; S&P 500 and Nasdaq fluctuated. US dollar index fell post-Fed meeting. Gold futures climbed on tumbling dollar and Treasury yields.

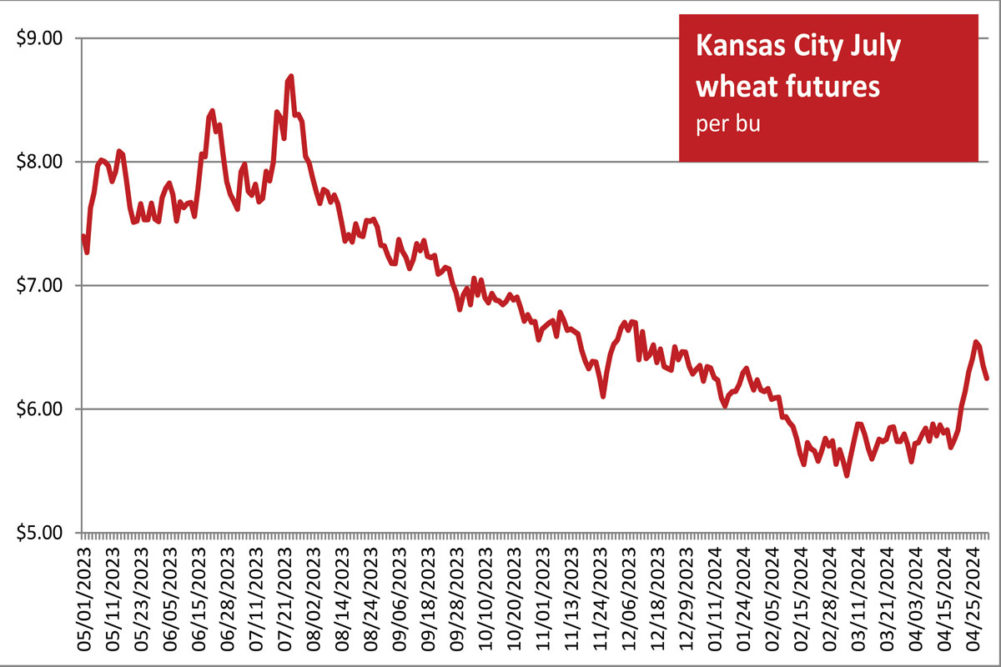

- Soybean futures climbed Wednesday in intra-market spread trading following the conclusion of an Argentinian oilseed worker strike. Soybean oil futures rebounded in technical moves after several futures established contract lows a day earlier when heavy deliveries against May were offset by commercial stops. Wheat futures were mixed, mostly continuing lower outside of prompt months and 2025 spring and soft wheat futures, under pressure from rain over dry Russian and US Great Plains wheat fields. However, rain supported corn futures Wednesday on concerns about planting delays. July corn added 4¢ to close at $4.50¾ per bu. Chicago July wheat dropped 4¢ to close at $5.99¼ per bu; July 2025 and beyond were higher. Kansas City July wheat declined 10¼¢ and closed at $6.25 per bu. Minneapolis July wheat ticked down 2¢ and closed at $7.02¼ per bu; May 2025 and beyond were higher. July soybeans added 7¼¢ to close at $11.70¼ per bu. July soybean meal was down $2.90 to close at $349 per ton. July soybean oil added 0.25¢ to close at 43.26¢ a lb.

- US crude oil prices declined about 3% Wednesday to a seven-week low. Pressuring prices was a US Energy Information Administration report indicating energy firms added a surprise 7.3 million barrels of crude into stockpiles during the week ended April 26 versus analysts’ expected 1.1-million-barrel decline. Also pressuring the market were the prospect of a Middle East ceasefire agreement and fading hopes for near-term US interest rate cuts that could boost oil demand. The June West Texas Intermediate light, sweet crude future was down $2.93 to close at $79 per barrel.

- The Federal Reserve bank’s decision to keep interest rates steady at the highest rates in more than 20 years had mixed effects on US stocks Wednesday. The DJIA was the only major index to post a decline. Fed chairman Jerome Powell scuttled speculation that the central bank might need to raise rates again to fully control inflation but said it would likely take longer than expected for the Fed to be confident inflation is moving toward its 2% target. The Dow Jones Industrial Average advanced 87.37 points, or 0.23%, to close at 37,903.29. The Standard & Poor’s 500 dropped 17.30 points, or 0.34%, to close at 5,018.39. The Nasdaq Composite deleted 52.34 points, or 0.33%, to close at 15,605.48.

- The US dollar index closed lower, keeping the daily up-down pattern intact, after the Federal Reserve meeting and the chairman’s comments.

- US gold futures climbed Wednesday, concurrent with a tumbling dollar and US Treasury yields. The June contract added $8.10 to close at $2,311 per oz.

Source Link: https://www.foodbusinessnews.net/articles/7-rain-carries-corn-higher-weighs-on-wheat