Single rate for all grain based ethanol: Grain Ethanol Manufacturers Association pitches for pricing reform

India’s Grain Ethanol Manufacturers Association (GEMA) raised key concerns regarding the government’s 20% ethanol blending target by 2025. Producers highlighted issues like viable ethanol pricing and feedstock supply challenges. GEMA proposed a single rate of ₹73.40 per litre for all grain-based ethanol and a mixed-grain approach to stabilize feedstock availability. The industry faces high operational costs, and maize demand for ethanol may impact other sectors, risking inflation and increased imports.

The Indian government has set a target of 20% ethanol blending by 2025, but ethanol producers are raising concerns about several challenges that need to be addressed in order to achieve this goal smoothly.

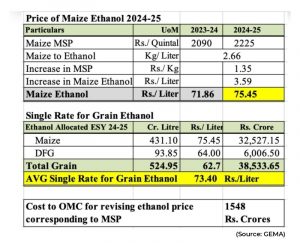

Grain-based ethanol producers in India have highlighted issues such as viable pricing for ethanol and the availability of feedstock for the Ethanol Supply Year (ESY) 2024-25 and beyond. In a recent presentation to Union Home Minister Amit Shah, the Grain Ethanol Manufacturers Association (GEMA) outlined the difficulties the industry is currently facing. GEMA proposed a single rate of Rs. 73.40 per litre for all grain-based ethanol.

In its presentation, GEMA highlighted the successes of the national biofuel policy, the operational losses experienced by producers, and proposed measures to ensure a stable and sustainable ethanol supply that aligns with the government’s blending target.

Oil Marketing Companies (OMCs) have allocated around 837 crore litres of ethanol against 970 crore litres of offers submitted by manufacturers across the country for ESY 2024-25 – Cycle 1. OMCs had invited tenders for the supply of 916 crore litres of ethanol for ESY 2024-25. The supply of grain ethanol is expected to increase to around 525 crore litres in ESY 2024-25, up from 370 crore litres in the previous ESY. Notably, 63% of this supply will come from grain, with maize contributing around 431 crore litres. According to GEMA, 11.46 million metric tonnes (MMT) of maize will be required to produce 431 crore litres of ethanol. While maize is a future crop, its current availability of 11.46 MMT is questionable.

The association detailed that losses in keeping the plant shut are higher, than in supplying ethanol at losses. If plant is kept non-operational – cost of manpower, establishment, finance & penalties of non-supply are fixed, which is approx Rs 9.50 per litre. The plant capacity reduces by 20%, in maize as compared to Damaged food grains (DFG) – this leads to higher fixed expense ratio in maize. GEMA noted that due to limited availability of DFG; industry has opted for maize, even though the losses are high – only to keep the plant running.

To address pricing pressures, GEMA has called for a single rate of Rs 73.40 per litre for all grain-based ethanol, based on a weighted average after factoring in the increase in the Minimum Support Price (MSP) of maize. The MSP for maize has risen by Rs 1.35 per kilogram to Rs 22.25, while open market sale rice is available at Rs 32 per kilogram from the Food Corporation of India (FCI).

According to GEMA, the 11.46 MMT of maize required for 431 crore liters of ethanol represents one-third of India’s maize production. An extreme shortage of maize could result in significant inflation and increased imports in other sectors.

To mitigate these challenges, GEMA suggested that a mixed grain approach would allow manufacturers to select the most viable grain for ethanol production. This strategy could also enhance accountability for feedstock in the grain ethanol industry. The association noted that a ₹40,000 crore investment by the grain ethanol sector could be saved from becoming non-performing assets.