Swelling granaries may prompt India to ease rice export curbs

New Delhi may relax rice export restrictions due to ample stocks and anticipated good harvests, benefiting millers and aiding the minimum support price (MSP) scheme. Proposed changes include replacing bans on non-basmati and broken rice with fixed export duties, along with reducing basmati rice’s minimum export price (MEP). These moves aim to ease pressure on granaries, boost revenue through export duties, and address concerns raised by exporters amid declining international demand and competitive pricing from Pakistan.

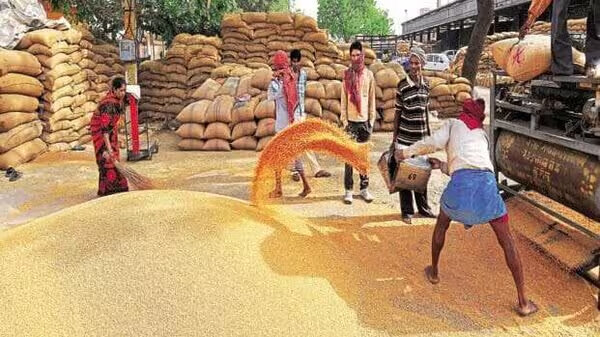

New Delhi: Swelling stocks and a looming harvest may prompt the government to relax curbs on rice exports, in a move expected to cheer millers and exporters, and aid the minimum support price (MSP) scheme.

Currently, basmati rice can be exported only above a floor price, parboiled rice exports attract a 20% export duty, and non-basmati and broken rice exports are completely prohibited. These curbs were brought in to ensure sufficient domestic stocks and cool prices.

An inter-ministerial meeting on 3 July proposed to replace the export ban on non-basmati and broken rice with a fixed export duty, as in the case of parboiled rice. It was also decided to reduce the minimum export price (MEP) on basmati rice. The proposal has been sent to the commerce ministry, an official aware of the matter said.

The confidence in relaxing these curbs stems from ample rice stock in warehouses and expectations of a good harvest amid a good monsoon forecast, both of which are expected to keep a lid on prices. At the same time, it eases the pressure on granaries, and fetches revenue in export duty.

“In the last inter-ministerial committee meeting, it was decided to send the matter (fixed duty on rice varieties barring basmati) to the commerce ministry. The proposal has been sent, and the ministry will examine it and devise a mechanism to monitor or review the fixed duty structure considering the changes in international rice prices,” the official cited above said. The ministry will also study basmati stocks lying with Indian exporters and the expected trend in global prices and bring a proposal before the committee of secretaries and ministers, which will take a final call, the official added.

According to the latest agriculture ministry estimates, this year is likely to see rice production at 136.7 mt compared to last year’s 135 mt. Trade estimates show a domestic consumption of around 100 mt this year.

Questions sent on Thursday to secretaries and spokespeople of commerce and food & public distribution ministries remained unansweredatpresstime.

Review amid pitch for relief The review comes after rice exporters pitched for relief last month, stating the restrictions are not only hurting the rice trade and mills, but also putting pressure on the Food Corp. of India (FCI) due to excess stocks. They also asked to reduce the export floor price to $800-850 per tonne from the existing $950. Some states like Chhattisgarh, Odisha and Telangana have declared bonus over and above minimum support price (MSP), which is raising subsidy outgo as well.

During the 1 April-11 June period, overall rice exports fell 34% to 3.2 mt, latest available data showed. Out of this, exports of non-basmati white rice plunged 78% to nearly 300,000 tonnes, broken rice 8% to 300,000 tonnes, and parboiled rice 11% to 1.5 mt.

In FY24, India exported 15.7 mt of rice, against 21.8 mt in FY23. This included non-basmati white rice (2.36 mt), broken rice (545,000 tonnes) and parboiled (7.57 mt). India is the world’s second-largest producer of rice after China and the largest exporter, contributing at least 40% to the global trade until export curbs were imposed.

FCI, which has to keep buffer stock of 13.5 mt tonnes of rice, had 3.72 times as much at 50.4 mt on 1 June, said B.V. Krishna Rao, president of The Rice Exporters’ Association (TREA). “Fresh crop will come from November. If it does not vacate warehouses for new harvest, it will not be able to give MSP support to farmers. If the government lifts the ban or allows exports with certain tariffs, millers will buy paddy, mill it and export it,” Rao said.

“Additionally, the government can control inflation and earn revenue by imposing export duty ranging between $30 and $120 a tonne, which can be used for price stabilization. Exporters are under-invoicing in the case of parboiled rice as there is a 20% export duty. To avoid 20%, what some exporters are doing is declaring a lower cost of their goods, expanding their margins from 2-3% to at least 5%, which is in a way hurting the government,” Rao added.

Local stocks boosted Limited exports of basmati 1509 variety have boosted local stocks, even before fresh harvest hits the market in September, worrying the farm community. Additionally, Pakistan, India’s rival in the global basmati market, is selling at around $700 per tonne, putting Indian exports at a disadvantage.

The government had imposed an MEP of $1200 per tonne on basmati rice in August, which was lowered to $950 in October. “Between November and up till now, basmati prices have gone down by 15-20% due to excess stocks in hand of millers and higher freight rates globally weighing on international demand,” said Akshay Gupta, business head of bulk rice sales at KRBL, world’s largest basmati rice exporter based in India. “The new crop of basmati rice will approach in September. There is a big carryover stock of old crops in hands of millers, especially of Pusa 1509 variety (which makes up one-third of total basmati rice). If the new crop comes in, the price of the old crop, particularly of Pusa 1509, will shrink significantly. This is causing concerns among farmers because if exporters have old crops, they will not buy fresh crops and farmers will have to sell them at low prices. $950 is restricting trade because there are certain varieties of basmati rice which are trading below $950 per tonne and we are unable to sell those varieties in the international market due to $950 MEP,” Gupta said.

“The other important point is that Pakistan, another supplier of basmati rice in the global market, does not have any export restrictions and is selling basmati rice at $750-800 per tonne, taking away the market from India,” Gupta added.