Wheat imports from war-torn Russia, Ukraine at 5-year high

Bangladesh’s wheat imports hit a five-year peak in FY24, surpassing 68 lakh tonnes, with 50% from Russia. This follows the May 2022 Indian export ban and war-induced disruptions. Government and private imports from Russia and Ukraine now proceed without significant barriers, stabilizing local markets. Despite global price drops, local prices remain high due to the strong dollar. Imports are dominated by private companies like City Group and Meghna Group, fostering market stability and reducing dependence on India.

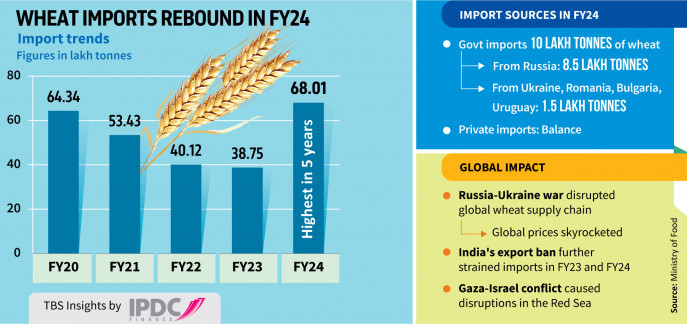

The grain’s total import now stands at a five-year peak in the fiscal 2023-24.

According to the Ministry of Food, wheat imports in FY24 exceeded 68 lakh tonnes, with around 50% shipped from Russia through both government procurement and private imports.

Of the government’s 10 lakh tonnes of imports, 8.5 lakh tonnes originated from Russia, with the remainder sourced from Ukraine, Romania, Bulgaria, and Uruguay.

This marks a relief from over-reliance on Indian wheat, as the abrupt ban in May 2022 had put Bangladesh’s wheat supplies in uncertainty just as the Russia-Ukraine war broke out in February that year, disrupting supplies from the world’s two breadbaskets.

In FY21, the two warring nations accounted for 38% of Bangladesh’s wheat imports, while 24% came from India.

Md Ismiel Hossain, secretary of the Ministry of Food, told TBS that the post-war crisis has been resolved and imports are now normal. “We can now import wheat from Russia and Ukraine without any payment issues,” he said.

He also noted that disruptions in the Red Sea due to the broader geopolitical tensions in the Middle East have eased and vessel operations are back to normal.

Bangladeshi consumers are increasingly incorporating wheat into their diets. The current annual wheat demand stands at 70-75 lakh tonnes. Imports meet nearly 85-90% of consumption.

Bangladesh’s wheat imports plummeted to 40 lakh tonnes in FY22 due to the combined impact of war-induced supply disruptions and the Indian ban, reducing global supplies by nearly two-thirds.

Private company officials and traders said prices of wheat and wheat-based products soared in the local market within two to three months of the war, mirroring global trends. But the situation has improved significantly in the last several months.

“Global wheat prices and supply are stable now. Most of our wheat is sourced from Russia and Ukraine, often passing through different countries,” Md Redwanur Rahman, head of sales and distribution at Bashundhara Food and Multi Food Products Ltd, told TBS.

He added that international wheat prices have returned to levels seen before the war, but local market prices reflect the impact of the dollar’s rise.

Abul Bashar Chowdhury, chairman of the Chattogram-based BSM Group, a commodity importer, said while wheat is being imported from both Russia and Ukraine, the majority is coming from Russia.

“Relatively stable exchange rates, especially after the introduction of the crawling peg, and declining wheat prices have encouraged businesses to import the grain,” said Bashar, also a wheat importer.

Several private sector companies, including City Group, Meghna Group, Bashundhara Group, Nabil Group, Sheikh Brothers, and Sainik Group, import most of the wheat.

Among them, Meghna, City, and Bashundhara import wheat and sell it as packaged flour. These importers brought in around 25 lakh tonnes of wheat in FY24 from Russia alone.

Taslim Shahriar, senior AGM of Meghna Group of Industries, told TBS that they are importing wheat from Russia without significant barriers, as well as sourcing the grain from Ukraine, Bulgaria, Argentina, and Brazil.

According to private importers, Russia and Ukraine are eager to export wheat, with substantial stocks available. They mention that much of the wheat exported through the UAE, Singapore, Kazakhstan, Bulgaria, Romania, and other countries that import from these two nations.

Ukraine, in particular, is sometimes exporting without negotiation to quickly clear its accumulated stocks.

Why local wheat prices still high

Soon after the war began, the price of flour even surpassed that of rice, causing concern among consumers. Now, with global wheat prices returning to pre-war levels, local prices still remain high due to the strong dollar.

According to the Trading Corporation of Bangladesh (TCB), in March 2022, bulk flour was sold for Tk35-36 per kg and packet flour for Tk40-45. Due to the war, prices rose sharply to Tk55 for bulk and Tk65-70 for packet flour.

Currently, prices have slightly decreased, with bulk flour priced at Tk40-45 per kg and packet flour at Tk55 per kg. This reflects a 20.56% and 16% decrease compared to the same period last year.

According to the Food Planning and Monitoring Unit’s report on 25 June, wheat from Russia, Ukraine, and the US is currently priced at $227-240 per tonne in the global market. This is a decrease from the peak prices of $350-400 per tonne observed after the war started.

Breaking dependence on India

In FY22, around 62.3% of Bangladesh’s wheat imports came from India, 13.3% from Canada, 8.7% from Ukraine, 7.6% from Australia, 4.7% from Argentina, and 2.1% from Russia.

However, India banned wheat exports on 13 May 2022 to protect its own consumers and this ban is still in place.

This restriction dealt a significant blow to Bangladesh as the global supply chain collapsed after the Russia-Ukraine war began in late February 2022.

Exports from these two major wheat suppliers — Ukraine and Russia — stopped, causing global prices to skyrocket. The combination of high prices and halted exports led to a near-standstill in wheat imports.

During the emerging global food crisis after the war began, the United Nations mediated the signing of the Black Sea Grain deal between Russia and Ukraine.

This agreement ensured that both countries would not disrupt each other’s grain exports. Initially a 120-day agreement, it was later renewed, gradually restoring grain exports to normal levels.

However, despite these efforts, government and private wheat imports faced difficulties in FY23 resulting in a sharp decline to 38.75 lakh tonnes.

Government officials and private companies confirm that wheat imports from Russia and Ukraine are now regular but with some payment difficulties in Russia owing to US sanctions. Most payments are managed in dollars through mediation by other countries.

Wheat price stability expected

The US Department of Agriculture forecasted in March 2024 that wheat production would rise in Argentina, Australia, and Russia. This is expected to contribute to stability in the international wheat market.

Wheat exports from July 2023 to February 2024 reached 35.6 million tonnes, an increase of 3.7 million tonnes compared to the same period last season, according to APK-Inform Analytic and Information Agency — a Dnipro-based agribusiness consulting agency in the CIS countries.

The firm estimates that wheat exports from Russia for the entire current season will total 52.5 million tonnes.

Source Link : https://www.tbsnews.net/bangladesh/wheat-imports-war-torn-russia-ukraine-5-year-high-895201